[Analysis] "Bitcoin, Binance Futures Market Sell Orders Increase... Larger Correction May Occur"

Summary

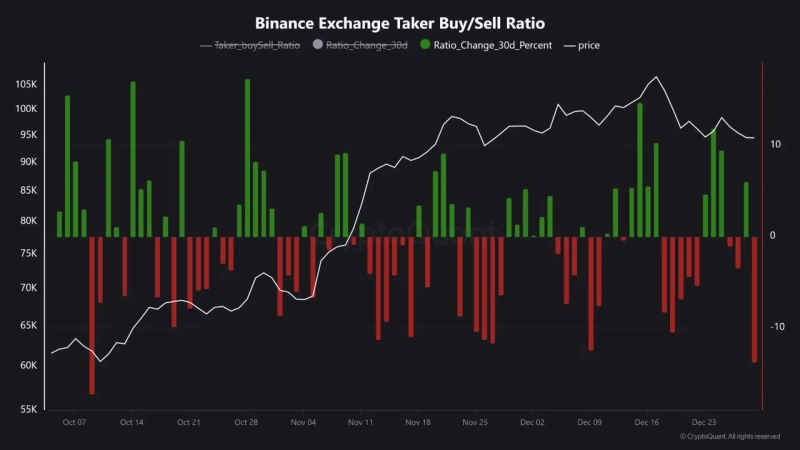

- An analysis suggests that due to the increase in sell orders in the Binance futures market, Bitcoin may experience a larger correction.

- According to the 30-day rate of change indicator for Binance market buy/sell orders, the buying pressure has recently decreased while the selling pressure has significantly increased.

- Bitcoin is currently trading down 1.03% from its previous price.

A recent analysis suggests that Bitcoin (BTC), which has been on a downward trend, may experience a larger correction in the future.

On the 31st (local time), CryptoQuant author Crazzyblockk stated, "By analyzing the 30-day rate of change indicator for Binance market buy/sell orders, we can gauge the extent of aggressive buy or sell orders executed by futures investors. Recently, the 30-day rate of change indicator for Binance market buy/sell orders shows that while the buying pressure has decreased, the selling pressure has significantly increased."

The author further predicted, "This means that market order participants are placing sell orders more aggressively than buy orders, and if this trend continues, a larger correction may occur."

Meanwhile, Bitcoin is currently trading at $92,655.55, down 1.03% from the previous day on CoinMarketCap.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.