[Analysis] "Bitcoin (BTC), Short-term Holder Profitability Decline... Adjustment Likelihood ↑"

Summary

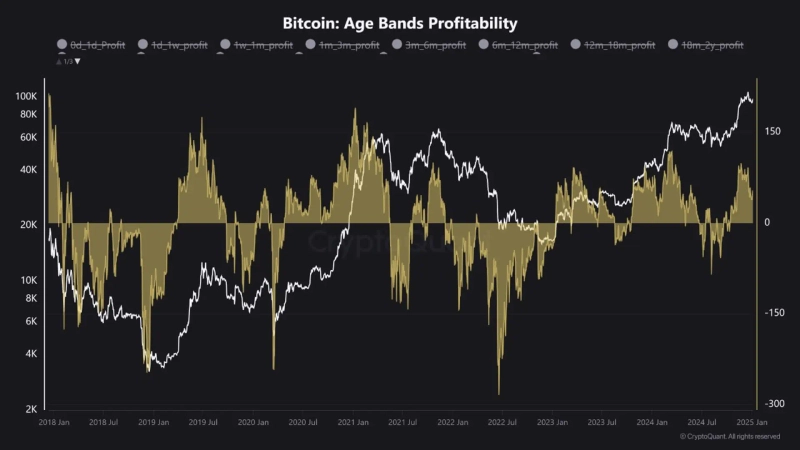

- "Bitcoin (BTC), the profit realization indicator for short-term holders has significantly decreased."

- "As the price failed to surpass the $108,000 mark, a weakening of market demand and bearish sentiment is suggested."

- "Therefore, it is analyzed that there is a high possibility of a price adjustment due to decreased demand and poor performance."

The profitability of short-term Bitcoin (BTC) holders has declined, raising the possibility of an adjustment.

On the 5th (local time), CryptoQuant author Crazzyblockk explained, "The profit realization indicator for short-term holders who have held Bitcoin for less than 155 days has significantly decreased. This is because Bitcoin failed to surpass the important price level after breaking through the $108,000 mark."

The author continued, "Generally, a decrease in the profitability of short-term Bitcoin holders suggests a weakening of market demand and a bearish sentiment in the medium to short term. Therefore, the current situation indicates a high possibility of a price adjustment due to decreased demand and poor performance."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)