Editor's PiCK

[Analysis] Short-term Demand for Bitcoin Decreases... Possibility of Sideways Movement Increases

Summary

- An analysis has emerged indicating that the short-term demand for Bitcoin is decreasing.

- Hot capital has plummeted to $32 billion, marking a 66.7% decrease from the peak.

- The decrease in Bitcoin's trading volume and funding rate suggests an increased possibility of a sideways phase.

An analysis has emerged indicating that the short-term demand for Bitcoin (BTC) is decreasing.

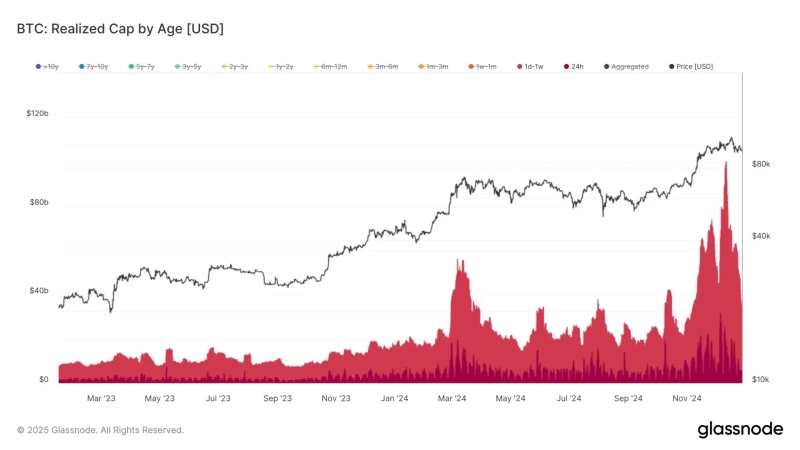

On the 10th (local time), Glassnode stated on X, "The short-term demand for Bitcoin is weakening," adding, "The level of hot capital (capital activated in the last 7 days) has plummeted to $32 billion." This marks a 66.7% decrease from the peak recorded on December 12 last year (approximately $96.2 billion).

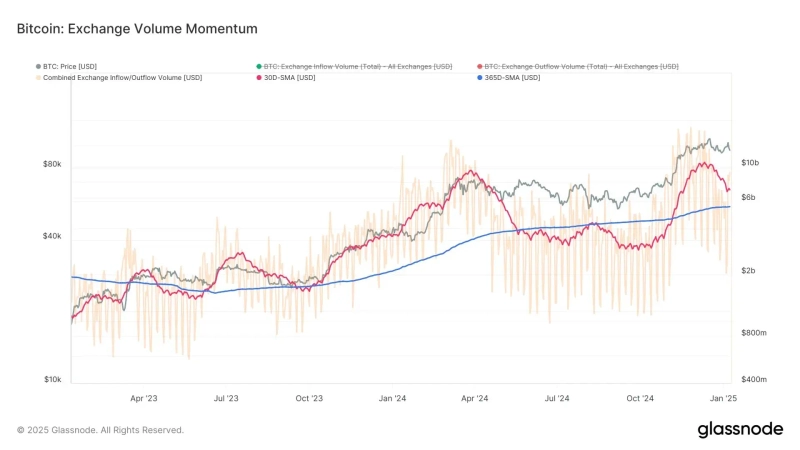

Additionally, the decrease in Bitcoin's trading volume and the low funding rate also indicate a decline in short-term demand for Bitcoin. Glassnode noted, "The 30-day average trading volume of Bitcoin is approaching the 365-day average," and "The perpetual futures funding rate for Bitcoin is also below the neutral value of 0.01%."

They further analyzed, "This shows that the capital flow in the market has decreased," and "The weakening of short-term demand for Bitcoin increases the possibility of a sideways phase or further adjustment."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)