Summary

- It was reported that retail investors are sending bullish signals to the market by increasing their accumulation of Bitcoin.

- Recently, retail investors purchased about 25,600 BTC, which is expected to serve as a price support base.

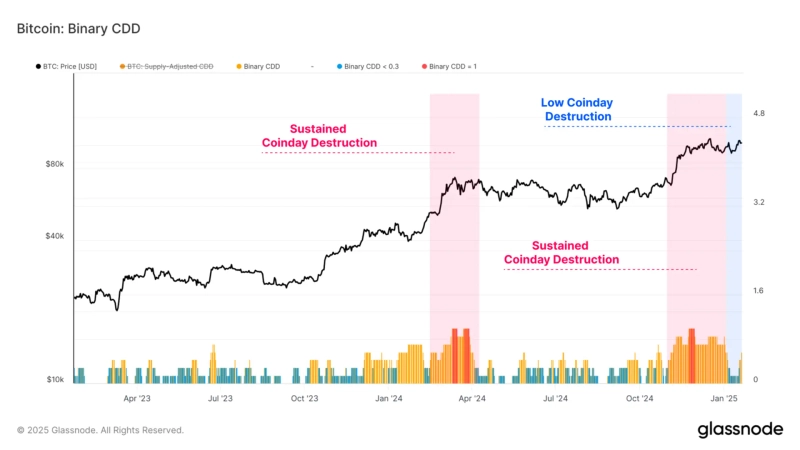

- The decline in the CDD indicator indicates that the selling pressure from long-term investors has decreased, creating a favorable environment for Bitcoin prices.

There is a claim that the possibility of a Bitcoin (BTC) price increase is growing due to the surge in Bitcoin buying activity by retail investors (holding less than 10 BTC).

On the 21st (local time), BeInCrypto stated, "Retail investors' Bitcoin buying activity has surged," and "this will serve as a foundation for future Bitcoin increases."

According to Glassnode data, retail investors recently purchased 25,600 BTC. This is approximately 2.71 billion dollars (about 3.882 trillion won).

The media explained, "Retail investors are a support base for Bitcoin prices," and "they act as a buffer zone during corrections and as a strengthening factor for price increases during bull markets."

Furthermore, the decline in the CDD indicator is noticeable. Bitcoin CDD, which signifies the amount of Bitcoin deposited in exchanges, generally helps to understand the selling sentiment of long-term holders.

The media stated, "The CDD significantly decreased in January, reducing the selling pressure of long-term investors," and "as a result, the holding sentiment of long-term investors has grown." They continued, "This change has created a favorable environment for Bitcoin price increases," and "the challenge for Bitcoin to reach 110,000 dollars will continue."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)