Summary

- Bitwise stated that governments and corporations must purchase Bitcoin from individual investors.

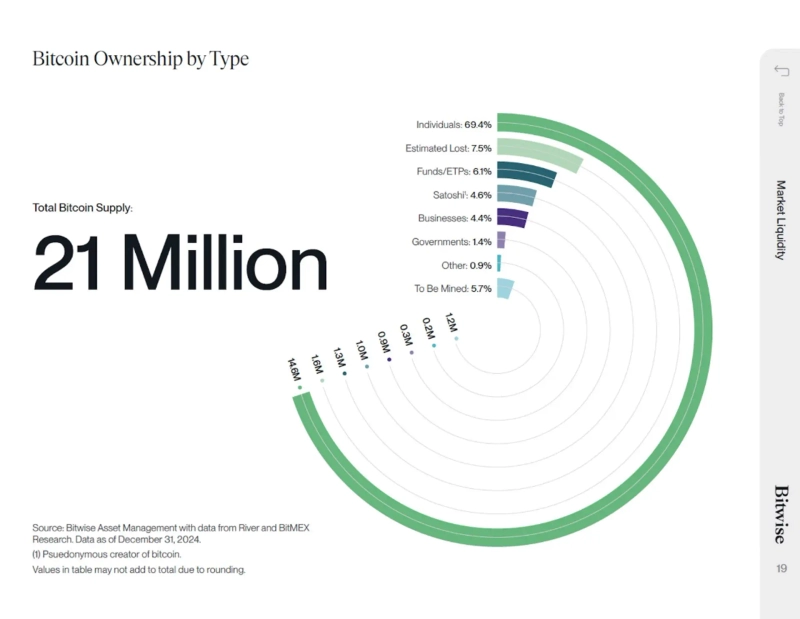

- It was analyzed that the price of Bitcoin is greatly influenced by the 69.4% held by individual investors.

- They warned of the possibility that the 140,000 BTC remaining in the OTC market could be depleted, leaving institutions with almost no Bitcoin to acquire.

There is an opinion that institutional investors should buy Bitcoin (BTC) from individuals.

On the 10th (local time), Bitwise stated on X, "For corporations and governments to purchase Bitcoin, they must buy from individuals willing to sell," adding that "market dynamics will become interesting." Hunter Horsley, CEO of Bitwise, also mentioned on X, "Every new buyer must find a seller," and evaluated that "the price of Bitcoin depends on individuals holding BTC."

The Bitwise report shows the distribution of the total supply of Bitcoin. Individual investors hold 69.4% of all Bitcoin. Governments and corporations own 5.8% of Bitcoin.

Previously, analysts from The Block also stated, "Only 140,000 BTC remain in the OTC market," and warned that "if strategies buy three more times or Bitcoin spot ETFs accumulate Bitcoin on the same scale as in January, all Bitcoin in the OTC market will be depleted." They further added, "There is almost no Bitcoin left for institutions to buy."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)