Summary

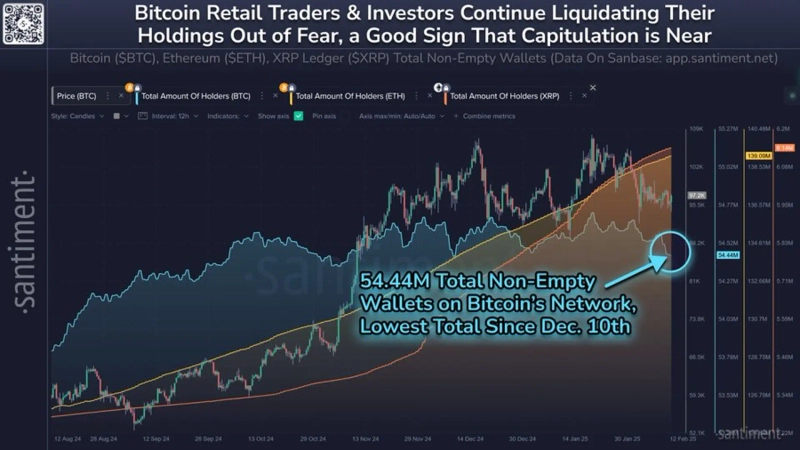

- In the past three weeks, the number of Bitcoin holding wallets has decreased by 277,240, indicating that the exodus of small investors is the cause of the recent decline.

- The on-chain analysis platform Santiment stated that the exit of small investors is a positive signal for Bitcoin prices in the medium to long term.

- From an investment perspective, the adjustment in Bitcoin is seen as an opportunity for whales to absorb the coins released by small investors.

An analysis has emerged suggesting that Bitcoin's (BTC) recent decline is due to the exodus of small investors.

On the 13th (local time), the on-chain analysis platform Santiment reported on X (formerly Twitter), "The recent decline in Bitcoin appears to be due to the exit of small investors. The number of Bitcoin holding wallets has decreased by 277,240 compared to three weeks ago."

Santiment further explained, "Historically, the exit of small investors is a positive signal for Bitcoin prices in the medium to long term. The coins shed by small investors are absorbed by whales, who utilize capital to lift the market when crowd FUD is at its peak."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)