[Analysis] "Bitcoin: Short-term Investor Selling Pressure Weakens... Long-term Investors Show Limited Selling Despite Volatility"

Summary

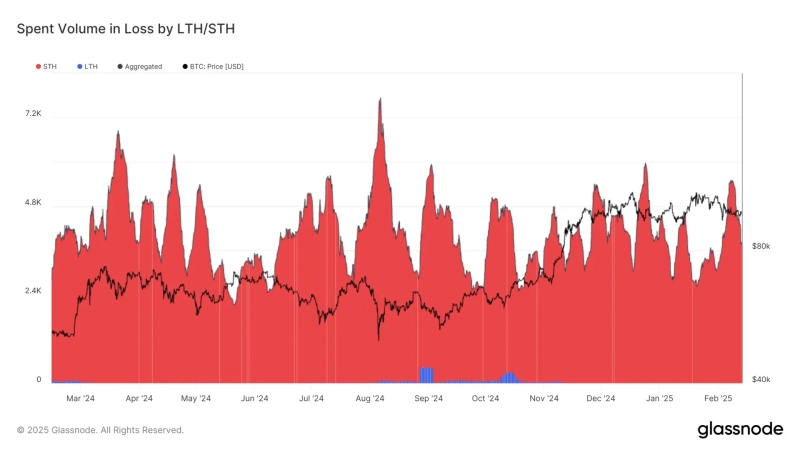

- Bitcoin's price declined, and short-term holder loss selling decreased to 3800 BTC.

- Glassnode reported this is at annual average levels and short-term holder selling pressure has stabilized.

- Long-term investor loss selling remains minimal despite volatility.

An analysis suggests that short-term holder (STH) selling at a loss has decreased while Bitcoin (BTC) price declined following the U.S. Consumer Price Index (CPI) announcement yesterday.

On the 13th, Glassnode, an on-chain digital asset analysis platform, stated via X (formerly Twitter) that "short-term holder loss selling peaked at 5500 BTC early this month but has now decreased to around 3800 BTC," adding that "this is similar to the annual average of 3500 BTC."

Meanwhile, long-term investors appear largely unaffected by recent price volatility. Glassnode added that "short-term holders are showing relatively stable conditions compared to the extreme pressure experienced in previous selling phases," and "long-term investor loss selling remains at minimal levels."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)