PiCK

"Multi-trillion Won Market"...Top 5 Banks Eye Virtual Asset Custody Market

Summary

- Major commercial banks are entering the virtual asset custody market, expecting a multi-trillion won market to form once corporate investment is permitted.

- Shinhan Bank is pursuing capital increase in KDAC to proactively respond to custody market changes.

- KB Bank and other banks are strengthening cooperation with cryptocurrency exchanges and competing for customer acquisition.

Shinhan Invests 1 Billion Won in KDAC

KB Establishes Korea Digital Asset

Hana, Woori, and NH Secure Allies

Strengthening Cooperation with Cryptocurrency Exchanges

Major commercial banks are eyeing the custody market, which involves storing cryptocurrencies in secure third-party locations. This comes as corporate virtual asset investments are gradually being permitted, leading to expectations of explosive growth in the cryptocurrency custody market.

According to financial industry sources on the 14th, Shinhan Bank is pursuing a capital increase in Korea Digital Asset Custody (KDAC) through Shinhan Venture Investment. The investment is reportedly around 1 billion won. With existing investments (500 million won), total investment will grow to 1.5 billion won, surpassing co-shareholder NH Bank's investment (1 billion won). Shinhan Bank had previously invested in KDAC in 2021.

Shinhan Bank's move to secure additional custody company shares is aimed at proactively responding to market changes. Custody refers to safekeeping and operating virtual assets held by corporations and individuals. Industry experts predict a market worth tens of trillions of won will emerge once corporate virtual asset investment is permitted. Korbit Research Center forecasts economic value creation of 46 trillion won by 2030 when corporate investment era begins in earnest. A Shinhan Bank official stated, "We will respond to the new market by strengthening cooperation with KDAC."

Besides Shinhan Bank, all other major commercial banks are collaborating with custody companies. KB Bank established Korea Digital Asset (KODA) with blockchain developer Hatch Labs. Additionally, Hana Bank partnered with BitGo Korea, while Woori Bank and NH Bank joined hands with VETAX and KDAC respectively.

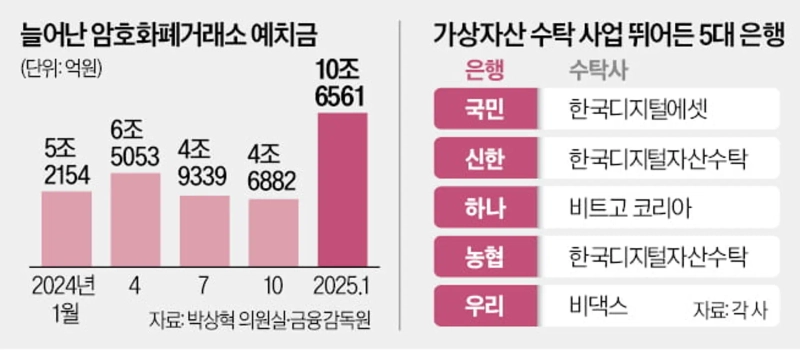

Partnerships between banks and cryptocurrency exchanges are also active. Competition intensified particularly after KB Bank took Bithumb, one of the two major cryptocurrency exchanges, from NH Bank. Bithumb chose KB Bank over NH Bank, its account partner for 7 years, to reduce the gap with market leader Upbit. Bithumb customers must open and link KB Bank accounts from next month. About 20,000 accounts have already been transferred in preparation. A banking industry official explained, "With exchange deposit amounts surging from 5 trillion to 10 trillion won in a year across Korea's top 5 cryptocurrency exchanges (UPbit, Bithumb, Coinone, Korbit, Gopax), securing exclusive exchange accounts could yield significant customer acquisition results."

This explains why Hana Bank is working behind the scenes to target relevant companies including Upbit, Korea's largest exchange whose contract with K-Bank expires this October. A financial industry official said, "The opening of the corporate market is on a different level compared to individual investors," adding "We are in discussions for partnerships with major companies." Woori Bank also expects collaboration with Upbit as Dunamu, Upbit's operator, has secured 1% stake in Woori Financial Group.

Park Jae-won reporter wonderful@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.