Editor's PiCK

[Analysis] "Bitcoin liquidity flow indicator turns negative... signals bearish market"

Summary

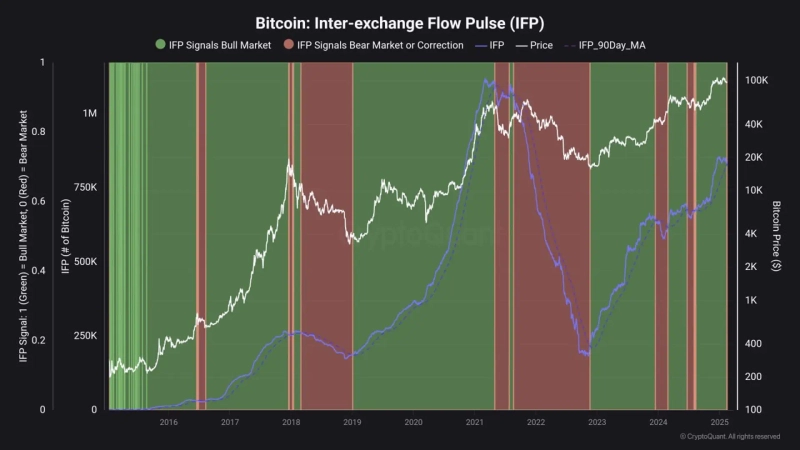

- Reports indicate that Bitcoin's liquidity flow indicator turning negative suggests the possibility of a bearish market beginning.

- Notably, the IFP indicator has turned downward, indicating decreased market risk appetite.

- When Bitcoin flows from derivatives exchanges to spot exchanges, it signals an imminent bearish market.

Concerns arise about a potential bearish market as Bitcoin (BTC)'s liquidity flow indicator turns negative.

On the 15th (local time), CryptoQuant author maartunn reported, "The IFP (Inter-Exchange Flow Pulse) indicator, which measures Bitcoin's movement between spot and derivatives exchanges, has turned bearish. This suggests the possibility of entering a downward phase as market risk appetite decreases."

IFP is an indicator that analyzes Bitcoin's flow between the two markets using CryptoQuant's data. Generally, when large amounts of Bitcoin move to derivatives exchanges, it signals a bullish market, interpreted as traders moving coins to open long positions.

Conversely, when Bitcoin begins flowing out of derivatives exchanges into spot exchanges, it indicates an imminent bearish market.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)