Editor's PiCK

Investment fever remains hot despite regulations... What coins are Chinese investors focusing on? [Min-seung Kang's Altcoin Now]

Summary

- In China, investment in altcoins including meme coins continues to attract attention and is actively conducted through OTC trading.

- Despite China's cryptocurrency regulations, cryptocurrency investment is increasing, with Hong Kong emerging as a key hub.

- Despite recent cryptocurrency market volatility, expectations for long-term upside potential are growing.

The cryptocurrency market, which rebounded sharply after Donald Trump's election as U.S. President, has recently shown signs of adjustment. Meanwhile, in China, investment in highly volatile altcoins (cryptocurrencies other than Bitcoin), including meme coins, continues to attract attention. Market experts analyzed that while Trump's 'tariff war' has intensified volatility in the overall cryptocurrency market, the long-term bullish outlook remains valid.

As Bitcoin (BTC)'s correction has prolonged, the upward momentum of altcoins is also being limited. The price of Ethereum (ETH), the leading altcoin, is trading at $2,701 (4,067,000 won on Upbit) as of 1:58 PM on the 16th on the Binance USDT market, down 0.67% from the previous day. The relative value of Ethereum to Bitcoin (ETH/BTC) has been declining weekly.

Today, Bitcoin (BTC) dominance (Bitcoin's share of total cryptocurrency market capitalization) has continued to decline for over a week at 60.88%. The recent decrease in dominance while Bitcoin price moves sideways indicates stronger rebounds in multiple altcoins.

"As China strengthens cryptocurrency regulations... Market evolves with DEXs and OTC trading"

Despite the Chinese government's strong cryptocurrency regulations, Chinese investors' enthusiasm hasn't cooled down. China is pursuing a dual strategy of strengthening cryptocurrency crackdowns in the mainland while actively supporting blockchain technology. For this, China is making Hong Kong its key cryptocurrency market hub.

Currently, while China completely bans ICOs, cryptocurrency trading and mining, the scale of cryptocurrency investment has actually increased. Singapore-based cryptocurrency venture capital Foresight Ventures recently analyzed through a research report that "While many view China as having completely banned cryptocurrencies, China's cryptocurrency market still exists and is evolving into new forms."

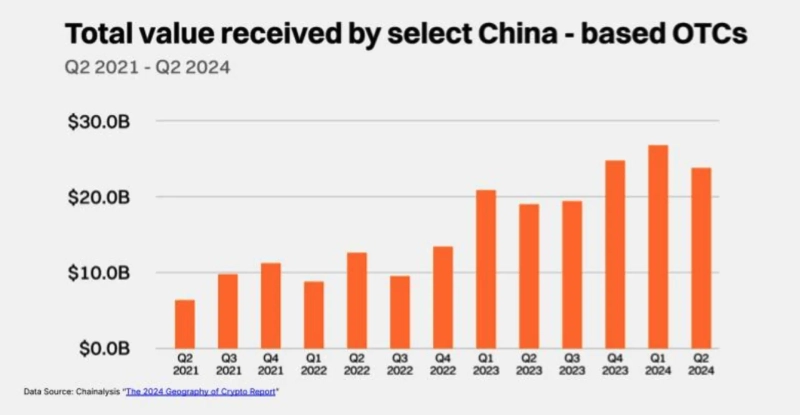

The report continued, "In China, cryptocurrency trading is mainly conducted through over-the-counter (OTC) trading," and explained that "institutions and venture capital are also actively participating in trading." According to the report, about 59 million investors in China were known to hold cryptocurrencies as of last year. The report analyzed that "As China's financial market development is slow and investment options are limited, investors perceive cryptocurrencies as a means of rapid wealth creation."

Chinese investors are particularly interested in meme coins like Dogecoin (DOGE), DeFi (decentralized finance) coins, and GameFi coins. The report analyzed that "Chinese investors are mainly young individual investors who also show great interest in new technologies such as AI infrastructure, Layer 2 projects, and Bitcoin Ordinals." Chinese investors often use stablecoins like Tether (USDT) to circumvent capital controls and primarily utilize DeFi platforms and decentralized exchanges to avoid authorities' surveillance.

According to WeChat data, Chinese investors have recently shown high interest in Bitcoin (BTC), Dogecoin (DOGE), TON Coin (TON), Tether (USDT), Ethereum (ETH), Solana (SOL), Shiba Inu (SHIB), and XRP. Particularly, meme coins have gained huge popularity, greatly surpassing Bitcoin in WeChat search volume. Foresight Ventures explained that "Chinese investors tend to have a high risk appetite and strongly feel FOMO (Fear of Missing Out) psychology."

Meanwhile, there are also predictions that China's cryptocurrency regulations will be relaxed. This comes after a Shanghai court ruled last November that individual cryptocurrency ownership is not illegal. However, while the court recognized the property value of cryptocurrencies, it emphasized that they are not allowed as payment or investment means. Recently, China has been intensively cracking down on illegal asset transfers abroad using cryptocurrencies.

There are also claims that Trump's pro-cryptocurrency policy could accelerate China's market reopening. Xiao Feng, CEO of HashKey Group, recently said in an interview with Hong Kong's South China Morning Post (SCMP), "If the U.S. actively fosters the cryptocurrency industry, China's acceptance timeline for cryptocurrency business could be shortened to within two years."

"Overall cryptocurrency market building bottom amid decline... Long-term bullish possibility"

Market experts viewed that while cryptocurrency market volatility has increased recently, expectations for long-term gains are growing. While bottom signals are being detected in the altcoin market, forecasts suggest the possibility of additional short-term declines cannot be ruled out. There are also observations that the cryptocurrency derivatives market has established a foundation for growth as leveraged positions have been largely liquidated.

Analysis suggests that the cryptocurrency market, which fell due to Trump's 'tariff bomb,' is finding stability while building a bottom. Cryptocurrency data analytics firm Santiment analyzed in a recent research report that "Cryptocurrency market volatility became extreme as President Trump announced new tariffs on Canada, Mexico, and China," and "Major decentralized finance (DeFi) platforms saw over $2 billion (approximately 2.8796 trillion won) in leveraged positions liquidated in just one day."

The report continued, "This massive liquidation affected over 700,000 cryptocurrency investors," but diagnosed that "ultimately, it served as a healthy correction for long-term market growth by eliminating excessive leverage." The recent surge in liquidation scale in the cryptocurrency derivatives market can be interpreted as a signal that the market is building a bottom, it explained.

Despite the prolonged correction, observations suggest that long-term optimism is gradually gaining strength in the industry. Global cryptocurrency exchange Bitfinex analyzed through its weekly research report that "The cryptocurrency market is responding sensitively to macroeconomic environments such as U.S. labor market data and trade risks," but "optimistic sentiment continues throughout the cryptocurrency industry."

In fact, since the resignation last month of Gary Gensler, known as the 'cryptocurrency grim reaper,' the number of cryptocurrency ETF applications in the U.S. has surged to 45. Additionally, the U.S. Commodity Futures Trading Commission (CFTC) is reportedly in discussions with the SEC to develop cryptocurrency regulations. Market participants expect institutional investor entry to become more active with ETF launches and regulatory improvements.

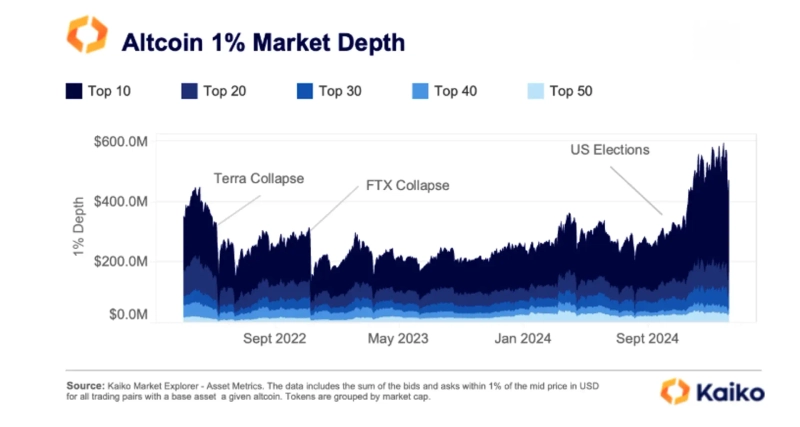

Moreover, cryptocurrency market liquidity has continued to recover since the U.S. election. Cryptocurrency data analytics firm Kaiko analyzed that "Since the U.S. election, as altcoin market outlook and investment sentiment improved, new altcoin ETF applications increased and trading volume greatly increased," but "In the current market, liquidity concentration continues around large-cap altcoins. Simultaneously, a new market structure is forming where liquidity is dispersing to some small-cap altcoins." This explains that cryptocurrency market liquidity is being reorganized around blue-chip altcoins and some small-cap alts.

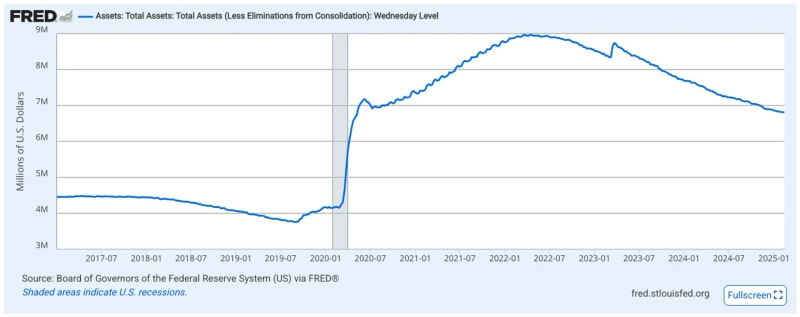

Some argue that while there are signs of U.S. monetary tightening easing, the 'altcoin season' will be difficult to arrive for the time being. Famous cryptocurrency analyst Benjamin Cowen recently diagnosed through his YouTube that "Currently, the U.S. Federal Reserve's Quantitative Tightening (QT) is still ongoing," and "As altcoins generally show decline compared to Bitcoin, it's still difficult for a true altcoin season to arrive." He explained that during the 2017 bull market, the Fed's quantitative tightening was ongoing, and the market subsequently turned bearish.

There are also opinions that the cryptocurrency market could see additional short-term declines. Cowen added that "The market capitalization of cryptocurrencies excluding Bitcoin and Ethereum continues to show a downward trend, with the possibility of up to 16% additional decline in the future," and "The market is approaching investors' final capitulation (mass selling)."

Meanwhile, forecasts suggest that the altcoin market will show strength in the long term. Famous cryptocurrency strategist Michael van de Poppe said through YouTube on the 14th that "Altcoins haven't hit their peak in this cycle yet," and forecasted that "The four-year cycle bull market could repeat this year. A final bull market could unfold in the coming fourth quarter."

The strategist analyzed that "The value of altcoins compared to Bitcoin is building a bottom. After the market crash early this month, the possibility of altcoin rebounds is increasing even more." He added that some altcoins including Wormhole (W), Omni (OMNI), Renzo (REZ), and Optimism (OP) are showing upward signals.

Min-seung Kang BloomingBit Reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.