PiCK

Currency value falls but exchange rate drops less... Bank of Korea's growing concerns

Summary

- The dollar value has fallen but the KRW-USD exchange rate has not dropped sufficiently due to political uncertainty and economic growth slowdown.

- The Bank of Korea's base rate decision is scheduled for the 25th, and markets expect a high possibility of a rate cut.

- The Bank of Korea's concern is due to foreign exchange market volatility, though a rate cut is unlikely to significantly impact the forex market.

Dollar at pre-martial law levels, but KRW-USD rate remains at 1440 level

If only considering dollar index impact

Exchange rate should be in early 1400s

But due to political instability and growth slowdown

Won remains over 30 won higher

BOK likely to cut rates but

FX market volatility still a major concern

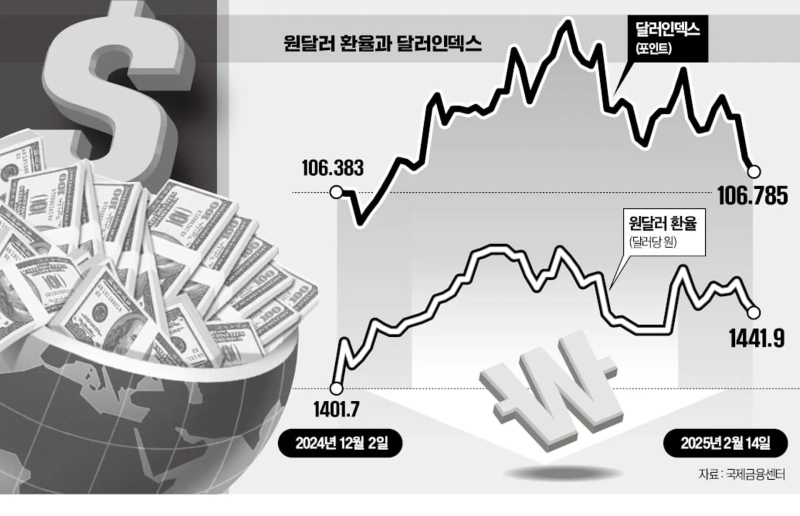

While the dollar value, which surged due to America's 'solo boom' and concerns over President Donald Trump's tariff war, has recently fallen to levels seen in early December last year, the KRW-USD exchange rate remains more than 30 won higher than at that time. Political uncertainty and concerns over declining growth potential appear to be weighing on the foreign exchange market. This is deepening the concerns of the Bank of Korea ahead of its interest rate decision on the 25th. While markets expect a high possibility of a base rate cut, unstable KRW-USD exchange rates remain a variable.

◇Failed to enter 1430 won range

On the 17th, the KRW-USD exchange rate (as of 3:30 PM) in the Seoul foreign exchange market closed weekly trading at 1441.70 won, down 1.80 won from the previous trading day. The exchange rate started at 1441 won, down 2.50 won, and mainly moved between 1438-1439 won during the session, but slightly rose at the end, failing to enter the 1430 won range.

The day's exchange rate decline (won appreciation) was analyzed as due to changes in assessment of the U.S. economy. With U.S. retail sales in January showing a 0.9% decrease from the previous month as announced by the U.S. Department of Commerce on the 14th, the possibility of the Federal Reserve accelerating rate cuts again has increased. The tariff war variable also subsided temporarily as President Trump agreed to extend mutual tariffs until April 1. The U.S. and Russia's agreement to start peace negotiations on Ukraine soon also contributed to dollar weakness.

◇Won drops less due to political instability

The issue is that the KRW-USD exchange rate is not falling sufficiently despite the dollar's decline. According to the Korea Center for International Finance, the dollar index, which measures the dollar's value against six major currencies, was at 106.785 points on the 14th. This is similar to the level of 106.383 seen on December 2 last year, just before Korea's martial law declaration. Consequently, the KRW-USD exchange rate has somewhat stabilized. The rate, which had risen to 1472.50 won on December 30 last year, has recently fallen by over 30 won to the 1440 won range. However, it remains about 40 won higher than the 1401.70 won seen on December 2, before martial law. Even considering the dollar index rise (0.38%), it should be around 1406 won but remains over 35 won higher.

BOK Governor Chang Yong Rhee analyzed at a press conference after deciding to hold the base rate at last month's Monetary Policy Committee meeting that "about 50 won of the 1470 won per dollar rate was due to dollar value fluctuations, and the remaining roughly 30 won was due to political instability." Given the dollar index trend and current KRW-USD exchange rate levels, this BOK assessment of political instability's impact on exchange rates is likely to hold. While Constitutional Court proceedings are ongoing, the political instability factor once reflected continues to burden the won.

◇BOK's deepening concerns

As the exchange rate fails to fall sufficiently, concerns are expected to deepen for the BOK ahead of its base rate decision. The BOK will hold its monetary policy meeting on the 25th. While there is a high possibility of lowering the base rate from 3.0% to 2.75% per annum, foreign exchange market volatility remains a major burden. This is because it's difficult to rule out the possibility of exchange rates surging again due to changes in U.S. conditions while political instability remains unresolved.

However, experts believe the BOK's rate cut itself is unlikely to significantly impact the foreign exchange market. NH Investment & Securities researcher Ah-min Kwon pointed out that "the won is being driven more by dollar index direction than interest rate differentials with the U.S."

Hyundai Research Institute views the recent high exchange rates as resulting from Korea's weak economic fundamentals. Taek-keun Lee, a research fellow at Hyundai Research Institute's Economic Research Office, said in a recent report, "The fundamental gap between the two countries, which is a key factor in exchange rate determination, is driving won weakness," adding that "exchange rates could actually fall if growth recovers through rate cuts."

Reporter Jin-kyu Kang josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.