Summary

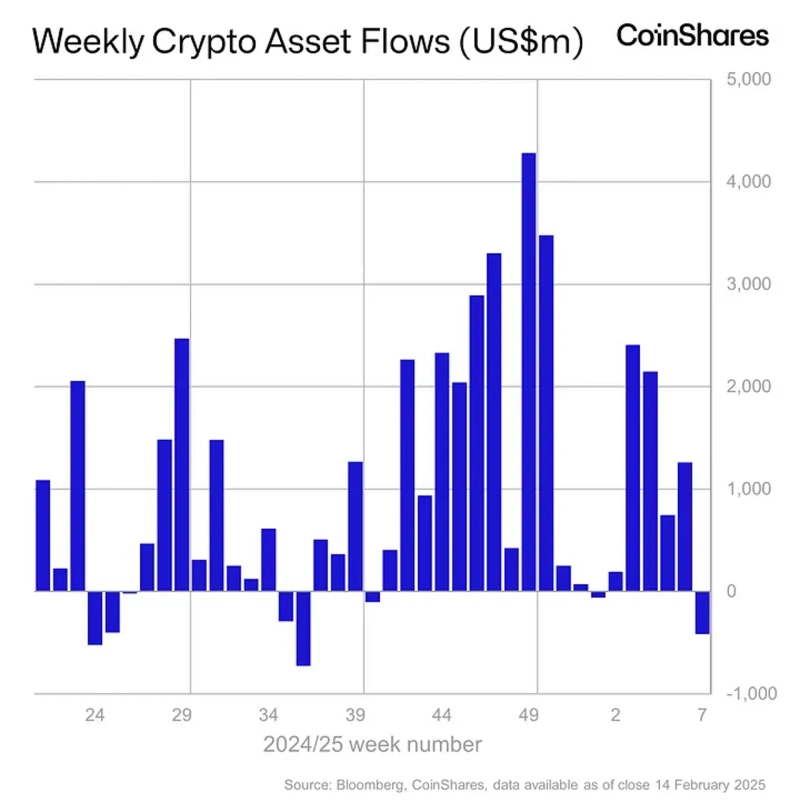

- Crypto investment products reported a net outflow of $415 million last week.

- Due to U.S. hawkish monetary policy and CPI impact, Bitcoin experienced a total outflow of $430 million.

- Conversely, Solana, Ripple, and Sui products saw net inflows of $89 million, $85 million, and $60 million respectively.

Crypto investment products experienced a net outflow of $415 million last week.

On the 16th (local time), CoinShares reported through its weekly fund flow report that "crypto investment products saw a net outflow of $415 million last week," noting that "most outflows occurred in the United States." The report added that "this was due to Fed Chairman Powell's hawkish monetary policy stance and the higher-than-expected U.S. January Consumer Price Index (CPI)."

The report stated that "Bitcoin (BTC) was most sensitive to interest rates," recording a total outflow of $430 million last week. However, it noted that interestingly, Bitcoin short (inverse) products also experienced outflows.

Solana (SOL) products saw a net inflow of $89 million. Additionally, Ripple (XRP) and Sui (SUI) received inflows of $85 million and $60 million respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)