Large-scale liquidations show limited impact on price decline... "Different from the past"

Summary

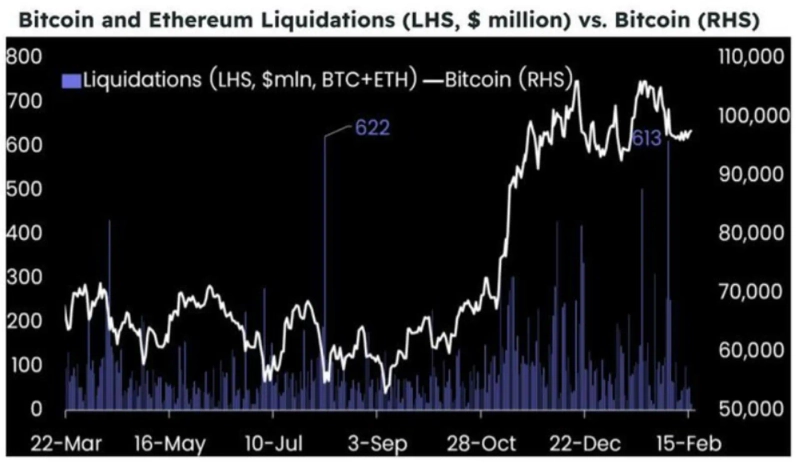

- Despite recent increases in cryptocurrency liquidation volume, price declines have been limited.

- The report indicates that leverage is low and traders are using stop-losses more strategically than in the past.

- Following the approval of spot cryptocurrency ETFs, analysis shows traders maintain long-term bullish expectations.

An analysis suggests that recent large-scale liquidations in cryptocurrency perpetual futures are having minimal impact on cryptocurrency price declines.

On the 19th (local time), Matrixport reported through its analysis that "While recent liquidations in Bitcoin (BTC) and Ethereum (ETH) reached $600 million, prices showed relatively small declines (compared to liquidation volume) and are forming a bottom," adding that "Unlike previous bull markets, current liquidations are not triggering severe price drops." They further stated that "The chain reaction of downward pressure caused by large-scale liquidations remains limited."

Matrixport suggested that "This indicates lower leverage in the market and traders using stop-losses more strategically than before," analyzing that this could be due to traders maintaining long-term bullish expectations following the approval of spot cryptocurrency ETFs.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![Shock that there is 'no US government backstop'… Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/b23cb4d1-e890-4f1c-aa52-f18f45dc8192.webp?w=250)