Short selling to resume for all stocks next month... More 'overheated stocks' to be designated

Summary

- Financial Services Commission Chairman Kim Byung-hwan announced plans to resume short selling for all stocks by the end of next month.

- The measure aims to increase foreign investor inflows and could positively impact inclusion in the MSCI Developed Markets Index.

- He explained that requirements for designating overheated short selling stocks will be eased, potentially leading to more stocks being designated.

First time in 5 years since COVID-19

Kim Byung-hwan: "Considering international credibility"

Short selling will be allowed for all listed companies from the end of next month. This comes 5 years after the complete ban implemented in March 2020 due to COVID-19.

Financial Services Commission Chairman Kim Byung-hwan (pictured) said at a regular press briefing at the Government Complex Seoul on the 24th, "When short selling resumes, we plan to allow it for all stocks," adding "If system checks confirm no issues, we will fully resume it on the 31st of next month."

Short selling is a trading practice where investors borrow stocks they expect to decline in price and sell them to profit from the difference. It was completely banned when market volatility increased after the pandemic, then partially allowed in May 2021 for 350 stocks in the KOSPI 200 and KOSDAQ 150 indices. It was completely banned again in November 2023 following illegal naked short selling incidents, though there were concerns about side effects like foreign investor exodus. Chairman Kim emphasized, "When we partially allowed short selling, we resumed it primarily for stocks with high foreign investor ownership," adding "After over a year of system and institutional improvements, there's no reason to limit it to certain stocks." He also noted that "international credibility must be considered."

Authorities decided to temporarily ease the requirements for designating 'overheated short selling stocks' to minimize individual stock volatility. Chairman Kim said, "We will ease the criteria for a month or two so that more stocks can be designated as overheated." Short selling is automatically prohibited for the next trading day when stocks are designated as overheated.

Kim Byung-hwan: "Time for bank lending rates to come down"

'Full short selling resumption', "Interest rates should follow market principles"

Analysts interpret Chairman Kim Byung-hwan's announcement of full short selling resumption on the 24th as a 'courtship message' to foreign investors, as there is a growing perception among overseas institutions that markets without short selling options are unfair. However, this creates the challenge of addressing concerns from retail investors worried about index declines after allowing short selling. Regarding bank interest rate practices, Chairman Kim urged lowering lending rates, saying "Base rate cuts should be reflected in lending rates."

Expectations for developed market index inclusion likely to rise

At the press conference, Chairman Kim said "Even with full short selling resumption next month, the impact on the overall capital market will be short-term" while acknowledging "concerns about short selling potentially concentrating on certain individual stocks."

This is also why he announced temporary easing of requirements for designating overheated short selling stocks. He explained, "We can discuss specific easing criteria next month after analyzing past data on short selling impacts and effects." This suggests the number of overheated stock designations could increase.

Korea is the only developed market that completely banned short selling. While intended to prevent unfair trading, many pointed out this prevented benefits like providing market liquidity and preventing overheating. The short selling ban was also cited as one reason for repeated failures to be included in the MSCI Developed Markets Index, a long-standing goal of the securities industry.

According to the Bank of Korea, foreign investors withdrew 2.6 trillion won from stock and bond markets last month. Lee Hyo-seop, a researcher at the Capital Market Research Institute, said "Just being included in the MSCI Developed Markets Index could bring up to 60 trillion won in foreign net buying."

Some speculate short selling bans could be reconsidered due to political demands. The FSC internally considered banning short selling if stock indices fall 15-20% below their 3-month average. A capital market insider noted "Clear guidelines on short selling policy must accompany full resumption to attract foreign investors back."

"Checking if interest rates follow market principles"

Regarding bank 'interest income controversy', Chairman Kim responded "It's time to lower lending rates." While acknowledging "There's a time lag for base rate cuts to reflect in the market, and household debt management was an issue late last year," he emphasized "Now it's time for banks to reflect this." He added "That's why the Financial Supervisory Service is checking if interest rate decisions follow market principles."

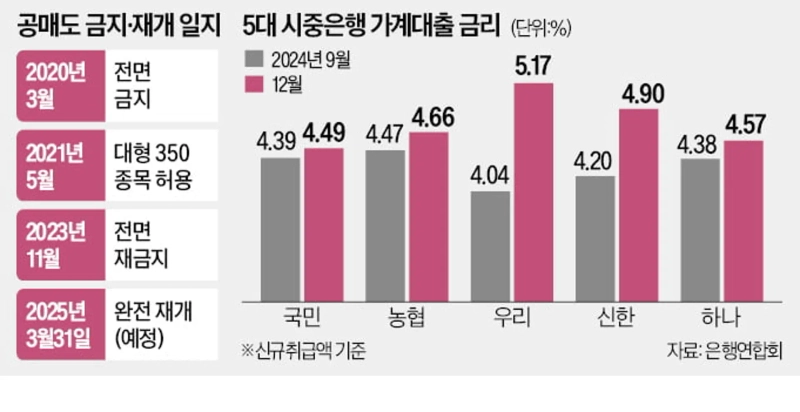

According to the Korea Federation of Banks, the average household lending rates of the five major commercial banks (KB, Shinhan, Hana, Woori, NH) in December 2023 were 4.49-5.17% annually, actually increasing 0.45-0.7 percentage points from September (4.04-4.47%) before rate cuts. The FSS requested banks submit data on benchmark and spread rate changes by borrower and product type, including justification and preferential rate application details, on the 21st.

Regarding fee issues arising from credit card companies' Apple Pay adoption, while stating "This isn't a matter for financial authorities to intervene," he added "We will closely monitor market conditions to ensure costs aren't passed on to merchants and consumers."

He sent a kind of 'warning' to Lotte Non-Life Insurance for applying an exception model in accounting for zero-surrender value insurance. Chairman Kim stated "If exceptions are allowed without sufficient grounds, there will be too many exceptions" adding "Supervisory authorities will check if there are acceptable grounds."

Reporters Yang Hyun-ju/Choi Seok-cheol/Shin Yeon-su hjyang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.