Editor's PiCK

[Analysis] Bitcoin Reaches Critical Turning Point... "Price Direction Will Be Determined"

Summary

- Bitcoin is reported to be showing a sharp decline, falling below the major support level of $90,000.

- Recent decline factors include the Bybit hacking incident and inflation, while potential rebound factors include large-scale long position liquidations and support from whale investors who have held for less than 6 months.

- $89,600 is identified as a psychological support level, suggesting potential for a rebound if maintained, but further decline is concerning if support levels break.

Bitcoin (BTC) has reached a crucial point that will determine its direction, according to analysis.

On the 25th (local time), a MacD CryptoQuant contributor stated through a report that "Bitcoin is showing a sharp decline, falling below the major support level of $90,000" and added that "it has reached a critical crossroads that will determine whether it goes up or down."

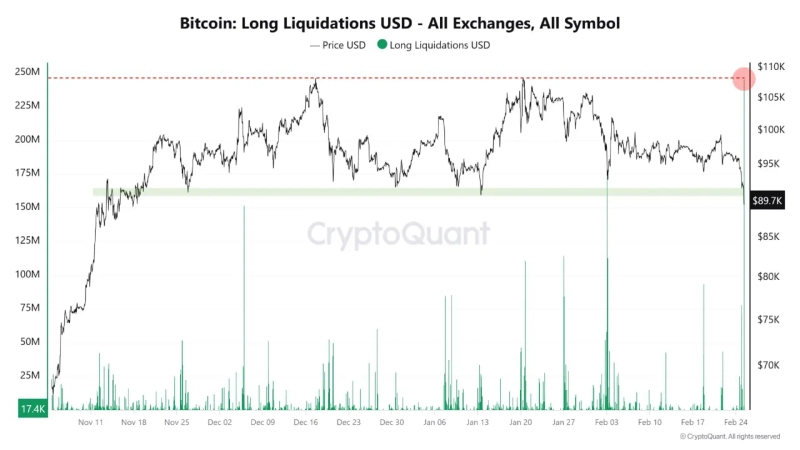

MacD identified the causes of Bitcoin's recent decline as △Bybit hacking incident △Trump administration's tariff policy △inflation occurrence. He then noted that the factors to expect a rebound at this point are large-scale long position liquidations and support from whale investors who have held for less than 6 months. He stated, "Mass liquidations technically thin out the order book depth, allowing even small quantities to create price rebounds," adding that "today saw the largest long position liquidation ($245 million) since November."

Furthermore, he mentioned that "$89,600 is the average purchase price for whales who have held for less than 6 months," explaining that "this is a psychological support level, and if these holders don't sell, the price could maintain this level and rebound." However, he added that "if the next support level breaks after this decline, further drops will occur."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit