Editor's PiCK

Trump-induced 'S Fear' amid Largest Hacking Incident in History... Can Bitcoin Rebound? [Kang Min-seung's Trade Now]

Summary

- Experts say that Bitcoin could continue its recovery if it breaks above $90,000, but there are concerns about further decline if it falls below $85,000.

- Due to this 2 trillion won hacking incident, investor sentiment in the cryptocurrency market has rapidly cooled, raising the possibility of weakened institutional demand for Ethereum.

- Experts forecast that Bitcoin could fall to as low as $74,000, analyzing the current market as an inflection point.

"Bitcoin will continue recovery if it stably breaks through 90k"

"Possibility of further decline if it falls below 85k support line"

As uncertainty grows due to US President Donald Trump's tariff war, fears of stagflation—where prices rise while economic growth slows—are spreading. Additionally, with the largest cryptocurrency exchange hack in history, investor sentiment in the cryptocurrency market, including Bitcoin (BTC), is rapidly freezing.

Market experts suggest that Bitcoin could continue its recovery if it stably breaks through $90,000, but if it falls below the $85,000 support line, the possibility of further decline increases. Some analysts note that the current cryptocurrency market is at a critical inflection point.

As of 5:30 PM on the 27th, Bitcoin is trading at 125.4 million won on Upbit's KRW market, up 2.18% from the previous day (equivalent to $85,927 on Binance's USDT market). At the same time, the kimchi premium (price difference between foreign and domestic exchanges) has been decreasing recently, showing 0.97%.

"Trump Tariff Impact... Stagflation Concerns Put Downward Pressure on Stock and Crypto Markets"

Global stock and cryptocurrency markets are facing downward pressure as concerns spread that the US economy is entering stagflation. This is because US inflation has rebounded to the 3% range while consumer sentiment has weakened, with consecutive signals of economic recession being detected. There are also forecasts that inflation pressure in the US will increase further as Trump's tariff policies take effect.

The Conference Board (CB), a US economic research organization, announced on the 25th that the US Consumer Confidence Index for February was 98.3. This is significantly below the expected figure (102.7) and marks the largest monthly decline in three and a half years. The lower-than-expected figure indicates that consumers have a negative outlook on the future economy. In particular, the consumer expectations index for short-term outlook also plummeted by 9.3 points to 72.9. Generally, when the expectations index falls below 80, it is considered a signal of economic recession.

President Trump's tariff policies are cited as the main background for the deterioration in consumer sentiment. According to the New York Times (NYT), President Trump participated in the annual Conservative Political Action Conference (CPAC) event held in Maryland on the 22nd (local time), saying, "I haven't even started fighting yet," signaling a strong tariff war. President Trump said, "We will collect a lot of money through tariffs." The 'reciprocal tariff' policy, which reviews tariff rates and non-tariff barriers for each country, is expected to be implemented as early as April.

Market participants expect that the US Personal Consumption Expenditures (PCE) price index for January, to be released at 10:30 PM (Korean time) on the 28th, will determine the market direction. Previously, the Federal Reserve (Fed) expressed concern in its January Federal Open Market Committee (FOMC) minutes that the Trump administration's tariff policies could push inflation above the target (2%) and stated that they are monitoring this closely.

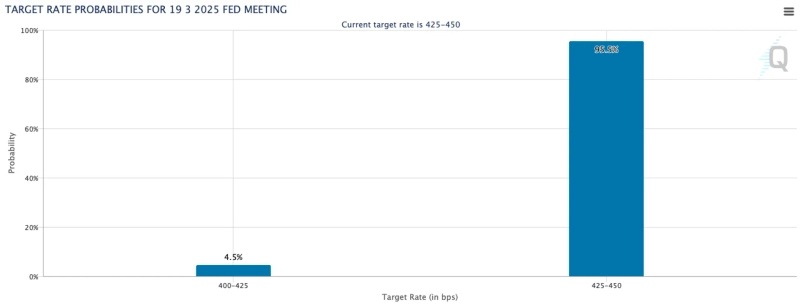

Meanwhile, the Chicago Mercantile Exchange (CME) FedWatch predicts a 95.5% probability that the Fed will keep interest rates unchanged in March, as of 5 PM today. FedWatch forecasts a 53.9% probability that the first interest rate cut this year will occur in June.

2 Trillion Won Ethereum Hack Shock... Can the Crypto Market Rebound Again?

Investor anxiety is intensifying as Bybit, one of the world's largest cryptocurrency exchanges, suffered a 2 trillion won hack. This incident is considered the worst hacking case in history, surpassing the Mt. Gox incident in 2014 (about $470 million) and the Poly Network incident in 2021 (about $611 million). As uncertainty over US interest rate policy grows and risk-averse sentiment spreads, the volatility in the cryptocurrency market is intensifying with the addition of this large-scale hacking incident.

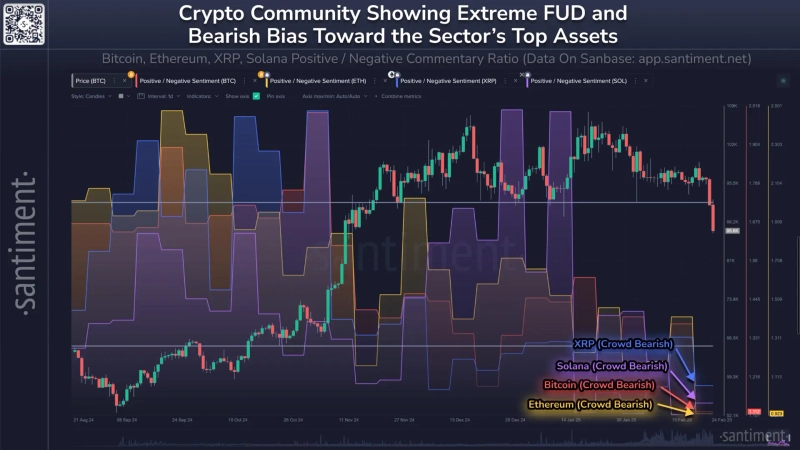

Cryptocurrency investor sentiment is freezing due to this large-scale hacking incident. Cryptocurrency data analytics firm Santiment analyzed on the 26th, "As Bitcoin retreated below $86,000, the cryptocurrency market is showing an overall downward trend. Investor sentiment is virtually bottoming out," adding, "Bitcoin, Ethereum, XRP, and Solana (SOL) are showing extremely bearish sentiment." They further added, "Historically, markets have often formed bottoms when FUD (Fear, Uncertainty, Doubt) spreads and 'surrender' psychology expands as investors panic sell and give up on stocks."

Derivative traders believe the worst is over. Cryptocurrency data analytics firm Kaiko analyzed, "As derivative traders reacted sensitively to the hacking news, short-term volatility in the cryptocurrency market surged," but added, "The implied volatility (IV) of long-term maturity options has now returned to normal levels. This suggests that traders believe the worst is over." There is also analysis that this hacking incident was somewhat less severe than the market turmoil caused by the Trump tariff issue earlier this month, but the impact was greater as it occurred in a much shorter time.

On the other hand, there are concerns that institutional demand for Ethereum may weaken as large volumes are concentrated with hackers. The report stated, "Bybit hackers have become the 14th largest Ethereum whale in the world," adding, "Their Ethereum holdings exceed those of the Ethereum Foundation and Ethereum founder Vitalik Buterin. With large volumes concentrated in a single group, the medium-term outlook for Ethereum and institutional investor demand are likely to be negatively impacted."

There is also analysis that as liquidity in the cryptocurrency market tightens, macroeconomic trends are becoming an even more important variable. Global cryptocurrency exchange Bitfinex stated in its weekly research report, "Recently, institutional buying has decreased dramatically. (Due to hacking effects, etc.) There has been capital outflow from Bitcoin spot ETFs, and leverage trading has also decreased, tightening overall market liquidity," forecasting, "The cryptocurrency market has shown clear coupling (synchronization) with traditional financial markets. Major market movements are likely to be determined by macroeconomic trends."

Meanwhile, North Korea's hacking group Lazarus has been identified as the culprit behind this hack, reportedly using phishing methods to steal assets. Regarding this hack, Bybit stated, "Manipulation occurred during a planned regular token transfer process." They explained that the hacking occurred during the process of transferring a large amount of Ethereum from a 'cold wallet' managed by multi-signature to a 'hot wallet,' and more than 500,000 coins including Ethereum (ETH) and staked Ethereum (stETH) were leaked to the hacker's wallet.

In fact, cryptocurrency exchanges often move large amounts of coins between cold wallets and hot wallets for security checks, preparing for user withdrawals, etc. Wallets in online status are called 'hot wallets,' while wallets in offline status are called 'cold wallets.'

"Bitcoin, 90k Recovery vs 85k Collapse... Market at a Crossroads"

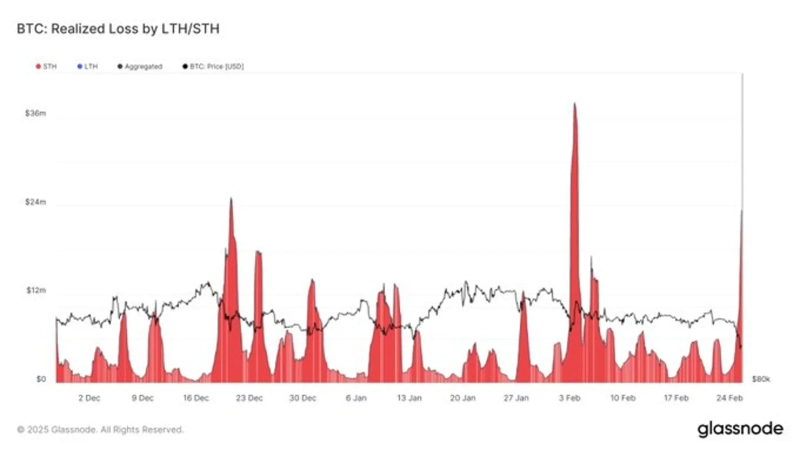

Market experts predicted that if Bitcoin falls below the $85,000 support line, the decline could widen. Conversely, they believed that if Bitcoin stably breaks through $90,000, it is likely to continue its recovery. On-chain analysts suggested that selling pressure has intensified as new and short-term investors' stop-loss selling has surged recently.

Expectations and concerns about Bitcoin's future direction are crossing after it fell below the $90,000 support line. Ayush Jindal, a NewsBTC researcher, analyzed, "Bitcoin has entered a new downward phase after breaking below the $90,000 support line," adding, "Bitcoin plummeted to around $86,000 and is attempting to rebound after forming a short-term bottom."

Jindal predicted, "If it breaks through the next resistance line around $91,250, it is likely to rebound strongly to the $93,500 resistance line," and "With additional upside, it has the potential to rise to $95,000-$96,400." Conversely, if the current support line of $86,000 collapses, it could fall further to $85,000 and $83,200.

Alex Kuptsikevich, FxPro's senior market analyst, also diagnosed, "Bitcoin has fallen about 20% from its all-time high and is at a crossroads between a bear and bull market." He predicted, "If additional declines occur, large-scale long position liquidations are likely to be triggered. Bitcoin is at risk of extending its decline to $82,000." The analyst added that technically, the possibility of further declines in Ethereum and Solana is increasing.

There is also analysis that while Bitcoin maintains a long-term upward trend, the possibility of additional declines in the short term is increasing. Katie Stockton, founder of Fairlead Strategies and a famous market analyst, diagnosed, "This decline is likely a short-term correction within a long-term bullish flow." She analyzed, "Bitcoin may not continue to experience extreme volatility, but in the short term, there is a possibility of an additional decline to $81,500. In the worst case, it could be pushed back to around $74,000, the next major support line."

The analyst added, "Clear signals of weakening in Bitcoin's long-term upward trend have not yet appeared," but "Some correction signals are being detected in the altcoin market. Ethereum has shown considerable volatility, falling nearly half from its December high last year." The analyst evaluated that while Bitcoin maintains an upward trend in the long term, Ethereum's outlook is neutral.

Kang Min-seung, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)