Summary

- President Trump's tariff imposition warnings and the resulting downward adjustments of economic growth rates worldwide were reported as a serious warning signal for investors.

- The U.S. House passed a budget resolution centered on tax cuts and fiscal spending reductions, which is interpreted as seeking ways to stimulate the economy while reducing the fiscal deficit.

- Tesla CEO Elon Musk highlighted the U.S. fiscal deficit situation and emphasized the federal government's spending reduction goals, but indicated that such plans could lead to welfare cuts.

Taiwan, Germany, UK Lower GDP Forecasts

Impact Will Worsen If Trade War Escalates

As President Donald Trump signals widespread tariff impositions, countries around the world are successively lowering their economic growth forecasts for this year.

Taiwan announced on the 26th that its growth rate for this year is expected to be 3.14%. This is 0.15 percentage points lower than the forecast made last November. Taiwan's Statistical Office explained that they lowered the growth rate forecast reflecting this year's budget cuts and the possibility of U.S. tariffs. Analysts suggest that Taiwan, which has significant trade with China (which has already begun a tariff war with the U.S.), has already entered the range of 'Trump tariffs'.

Germany, Europe's largest economy, also lowered its growth forecast for this year from 1.1% to 0.3% earlier this month. The UK dropped its forecast from 1.5% to 0.75%. Fabio Panetta, Governor of the Bank of Italy, predicted that "if all the tariffs President Trump has announced take effect and countries implement retaliatory measures, global economic growth could fall by 1.5 percentage points, and U.S. growth by 2 percentage points."

President Trump stated today that he "will soon impose 25% tariffs on the European Union (EU)."

U.S. Cuts Taxes and Reduces Government Spending... House Passes Budget Resolution

$4.5 Trillion Tax Cut Over 10 Years... $2 Trillion Reduction in Fiscal Spending

The U.S. House of Representatives has passed a budget resolution centered on tax cuts and fiscal spending reductions. President Donald Trump's tax cut promises and large-scale spending reduction plans have passed the first hurdle in Congress.

◇Government Spending Cuts Are Key

On the night of the 25th, the U.S. House of Representatives passed a budget resolution centered on $4.5 trillion (approximately 6,500 trillion won) in tax cuts and $2 trillion (approximately 2,900 trillion won) in government spending reductions over the next 10 years. It passed by a narrow margin with 217 votes in favor and 215 against. The House plans to achieve about half of the budget reduction, $880 billion, by cutting healthcare insurance budgets. It also aims to cut $330 billion from education and labor sectors. Instead, border security and defense budgets will increase by $300 billion.

The budget resolution is a kind of guideline that sets the overall revenue and expenditure scale and approximate spending items, without legal binding force. However, based on this resolution, the Trump administration plans to pass a large-scale budget adjustment bill. The key to the budget adjustment bill is extending the "Tax Cuts and Jobs Act (TCJA)," which is scheduled to expire at the end of this year. Provisions to reduce income taxes for individuals and corporations will also be reflected in the budget adjustment process.

The Republican Party is particularly targeting Medicare (health insurance for the elderly), Medicaid (health insurance for low-income individuals), and Social Security (old-age pensions), which account for more than one-third of the federal government budget. President Trump has argued that significant cost savings can be achieved simply by correcting improper aspects, such as benefits received by foreigners.

However, there is a consensus inside and outside Congress that it will not be easy to achieve the goal just by stopping leaking expenditures. Even within the Republican leadership, opinions are divided due to concerns about public backlash. According to Axios and others, Republican leadership is considering eliminating budgets related to the Inflation Reduction Act (IRA), which provides many benefits to Korean companies. According to Tax Foundation estimates, eliminating energy tax credits such as the IRA could save $920 billion over 10 years.

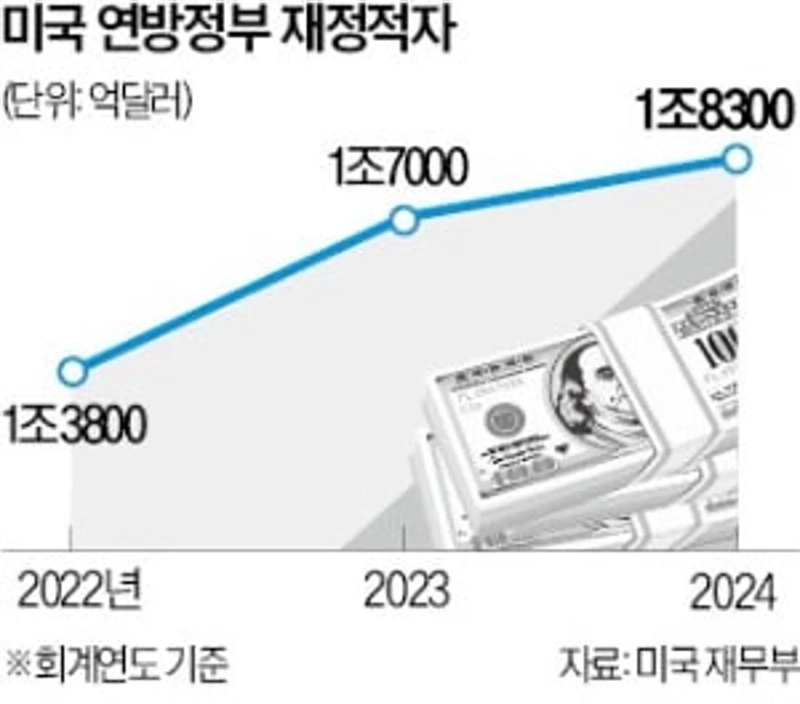

◇Fiscal Deficit Approaching $2 Trillion

The Republican-controlled House is pursuing tax cuts and spending reductions to stimulate the economy and reduce the fiscal deficit. The U.S. federal government's fiscal deficit last year was $1.83 trillion, approaching $2 trillion. Elon Musk, CEO of Tesla who leads the Department of Government Efficiency (DOGE), stated at a cabinet meeting today, "A country with a $2 trillion deficit cannot be sustained," and "DOGE's goal is to reduce annual spending by $1 trillion." This is half the original target ($2 trillion) but still a significant amount. U.S. federal government spending approaches $7 trillion annually.

However, some point out that it's not easy to reduce the fiscal deficit while pursuing large-scale tax cuts. There is also criticism that while spending is being cut to compensate for the decrease in tax revenue due to tax cuts, this process will impact welfare for low-income groups.

U.S. federal government spending has continued to increase even after the Trump administration took office. Reuters reported that federal government spending in the first month after the Trump administration took office was $710 billion, an increase from the same period last year ($630 billion). This suggests that despite the Trump administration's strong budget-cutting measures, such as freezing tens of billions of dollars in foreign aid and laying off more than 20,000 federal employees, the effect has not been significant.

Kim In-yeop/Lim Da-yeon reporters/Washington=Lee Sang-eun correspondent inside@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.