Ki Young Ju "Bitcoin (BTC) on-chain indicators positioned at the boundary between bullish and bearish"

Summary

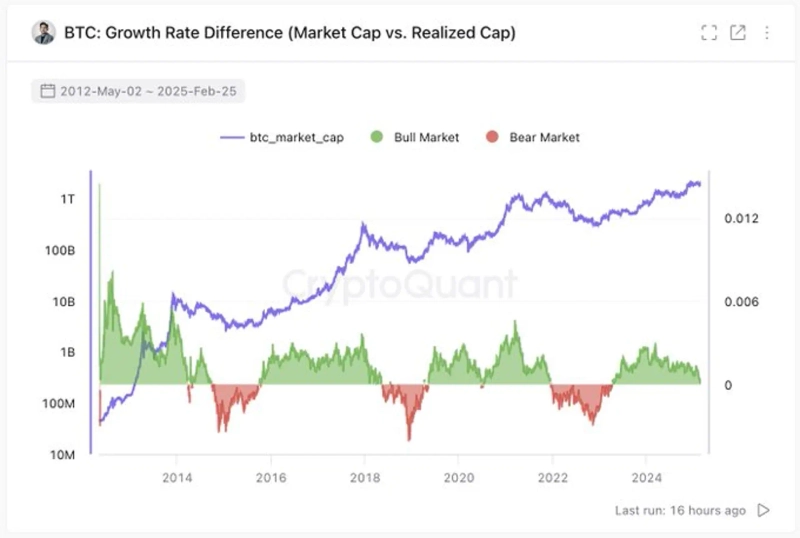

- He reported that Bitcoin's on-chain indicators are positioned at the boundary between bullish and bearish trends.

- He stated that directional betting strategies using leverage are not appropriate in the current situation.

- He said there is a low possibility of Bitcoin falling below $77,000, and it's likely to rise again after moving sideways.

Analysis suggests that Bitcoin (BTC) is positioned at the boundary between bullish and bearish trends based on on-chain indicators.

On the 27th, Ki Young Ju, CEO of CryptoQuant, stated through X (formerly Twitter), "Currently, Bitcoin's on-chain indicators are hovering at the boundary between bull and bear markets." He emphasized, "I don't think it's a good choice to strongly pursue directional betting strategies (long or short) using leverage at this time."

He projected, "Considering the typical 2-year cycle, this bull market could potentially continue until April," but added, "The next 1-2 months will be a crucial inflection point for the Bitcoin market." He explained that at least one more month of additional data is needed to definitively determine whether Bitcoin has entered a bear market.

CEO Ju stated, "I believe there is a low possibility that Bitcoin will fall below $77,000," adding, "Even in the worst-case scenario, Bitcoin is likely to move sideways around $77,000 for several months before rising again."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)