PiCK

Trump 'Picked' It... The 'Coin' That Surged 65% After His Surprise Message

Summary

- The article reported that as former President Trump emphasized strategic cryptocurrency reserves, prices of major coins including Bitcoin surged dramatically.

- It stated that Ripple, Solana, and Cardano surged following Trump's mention, with Cardano in particular rising more than 65% at one point.

- The article noted that the U.S. government's cryptocurrency reserves could attract attention for potentially reducing national debt and ensuring economic dominance.

"Stockpiling Ripple, Solana, Cardano"

Cryptocurrencies Soar After Trump's Comments

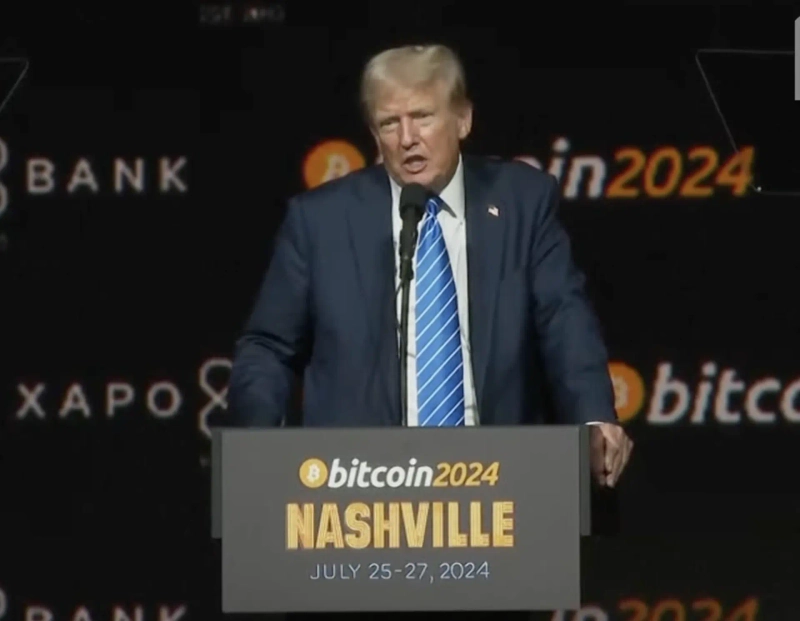

Trump Declares on Social Media

First Time Explicitly Stating 'Reserve' Intention

Bitcoin prices surged, recovering to the $94,000 level, after U.S. President Donald Trump once again emphasized on the 2nd (local time) that he would pursue strategic reserves of cryptocurrencies.

According to cryptocurrency information platform CoinGecko, as of 5 PM Eastern Time, Bitcoin was trading at $94,062 per coin, up 9.4% from 24 hours earlier. At the same time, Ethereum was trading at $2,527, up 13.4% from the previous day.

Ripple (XRP) and Solana (SOL), which President Trump mentioned, surged 32.2% and 23.1% respectively. Cardano (ADA) at one point skyrocketed more than 65% before settling at a price 57.7% higher.

In a post on his social media platform Truth Social, President Trump wrote, "America's cryptocurrency reserve will improve this industry, which has been in crisis after years of corrupt attacks by the Biden administration," adding that "(the strategic cryptocurrency reserve) will include XRP (Ripple), SOL (Solana), and ADA (Cardano)."

In a subsequent post, President Trump stated, "Clearly, Bitcoin (BTC) and Ethereum (ETH) will be at the center of the reserve, like other valuable cryptocurrencies," adding, "I also love BTC and ETH."

President Trump's statement about strategically stockpiling cryptocurrencies means that the U.S. government would continue to hold rather than sell bitcoins confiscated from criminals, or make new purchases with government funds. The cryptocurrency industry has argued that profits from stockpiling Bitcoin and other cryptocurrencies could help reduce America's $36 trillion national debt and ensure U.S. economic dominance if the world economy ever operates on cryptocurrencies.

The executive order issued by President Trump on January 23 after his inauguration included provisions for a working group to review cryptocurrency policies and submit a report within six months containing legislative proposals, including an assessment of national-level digital asset reserves. However, the executive order did not explicitly mention Bitcoin or other cryptocurrency reserve plans, which disappointed some investors.

This is the first time President Trump has explicitly expressed his intention not only to hold and accumulate (stockpile) cryptocurrencies but also to create a "reserve," according to U.S. economic media CNBC. CNBC explained that while previously it meant the U.S. government would store rather than sell cryptocurrencies it already holds, the term "reserve" used this time implies that the government would actively and regularly purchase cryptocurrencies.

Reporter Jong-hyun Song scream@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.