US Faces Backlash from 'T-Fear', Projected to Experience Negative Growth in Q1... "Concerns of Great Depression Repeat"

Summary

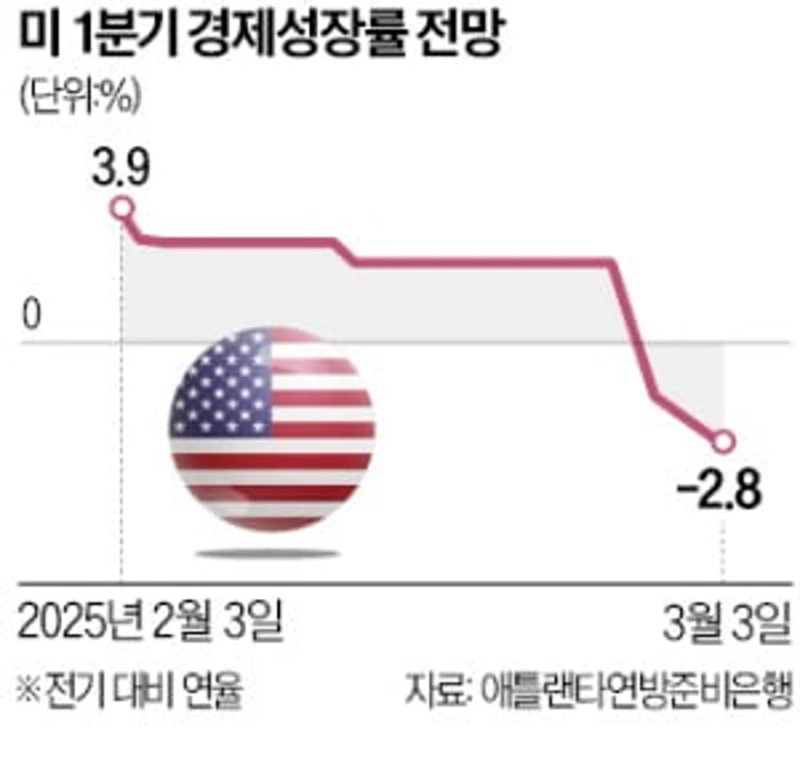

- The US economy is projected to experience negative growth of 2.8% in Q1 due to the impact of tariff policies, raising concerns about stagflation and recession.

- Consumer goods companies and the auto industry reported they have no choice but to pass tariff costs on to prices, leading to expected consumer price increases.

- The possibility of interest rate cuts is being discussed to respond to US economic slowdown, with the bond market showing a 92.4% probability of two or more rate cuts within the year.

Is the US Falling into Recession?

Stagflation Fears Loom

"China & Mexico are 1st and 2nd Product Suppliers"

Consumer Goods Companies Hit Hard... Target Down 13%

Mexican Agricultural Products to Increase Prices Next Week

Auto Industry: "Some Models Will Rise by 25%"

"Q1 Growth at Negative 2.8%"

Consumer Sentiment Plummets

10-Year Treasury Yield at 4-Month Low

Goldman Says "Recession Probability Very Low"

Fears of 'T(tariff) Fear' are growing that the US will fall into recession due to President Donald Trump's tariff policies. Companies have stated they will have to pass tariffs on to product prices, freezing consumer sentiment. Projections suggest the US economy may experience negative growth in Q1 this year.

◇ "Will Raise Fruit Prices Next Week"

On the 4th (local time), the S&P 500 index on the New York Stock Exchange closed at 5778.15, down 1.22% from the previous trading day due to the impact of tariffs against Canada, Mexico, and China. This is the lowest level since Trump was elected last November. The Dow Jones fell 1.55% and the Nasdaq index dropped 0.35%.

Consumer goods companies were directly hit by tariffs. Shares of North American electronics retailer Best Buy and retail chain Target fell 13.3% and 3% respectively. Best Buy CEO Cory Barry said, "China and Mexico are the first and second sources of products we sell," adding, "As suppliers are expected to pass on tariff costs to retailers, US consumer prices are likely to rise." Target CEO Brian Cornell also said, "Due to tariffs, we may have to raise fruit and vegetable prices this week." Cornell hinted at price increases for avocados, strawberries, bananas, and other products, saying, "We rely heavily on Mexican agricultural products during winter." New York Federal Reserve President John Williams said, "The impact of tariffs on prices will partially appear within the year."

The auto industry, which forms the North American supply chain along with Mexico and Canada, is also on high alert. Brian Barnett, mayor of Rochester Hills, Michigan, where auto manufacturers are concentrated, pointed out, "If car prices rise by $6,000-8,000 (due to tariffs), sales and production will decrease by 15%, and 9% fewer workers will be needed." General Motors (GM) shares fell 4.56% and Ford dropped 2.88% on this day.

Consumer sentiment is rapidly cooling. The University of Michigan Consumer Sentiment Index fell from 74 in November last year to 64.7 last month. The index indicates that consumers view market prospects positively if above 100, and negatively if below.

◇ Warnings of 'Great Depression Repeat'

The US economy, which had been racing ahead despite the global slowdown trend, has now hit the brakes. There are concerns about negative growth and even a possible replay of the "1930s-style Great Depression." The Atlanta Federal Reserve projected that US economic growth for Q1 this year will record -2.8% on an annualized basis compared to the previous quarter. Last month's forecast was 3.8%. If the US economy experiences negative growth, it would be the first time in three years since Q1 2022, right after the COVID-19 pandemic. Analysis suggests that growth momentum will also be impacted by the effects of Trump's tariff war.

The yield on 10-year Treasury bonds, the US bond market benchmark, temporarily fell to a 4-month low of 4.15% per annum on the 4th. This is a 0.36 percentage point drop in one month. Analysis suggests this reflects anticipation that the Federal Reserve (Fed) may cut interest rates to prevent economic slowdown. During this period, the probability of two or more rate cuts within the year as projected by the US Treasury market rose from 57.4% to 92.4%.

Bloomberg Economics analysts Maeva Cousin and Rana Sajedi pointed out that the average US tariff rate is currently at its highest level since the 1940s, adding, "This is enough to increase the possibility of stagflation." Andrew Wilson, Deputy Secretary General of the International Chamber of Commerce (ICC), warned, "If the tariff plans are not withdrawn, the US could face a crisis similar to the Great Depression of the 1930s."

In contrast, Goldman Sachs CEO David Solomon argued, "The probability of the US economy falling into recession is very low." US Treasury Secretary Scott Bessent said, "In the medium term, what we're focusing on is Main Street (the real economy)," adding, "Wall Street (the financial sector) has done well and can continue to do well, but we're focusing on small businesses and consumers."

Kim In-yeop, Reporter inside@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.