"Bitcoin Chart Similar to NASDAQ 25 Years Ago...Potential Headwinds for Risk Assets"

JOON HYOUNG LEE

Summary

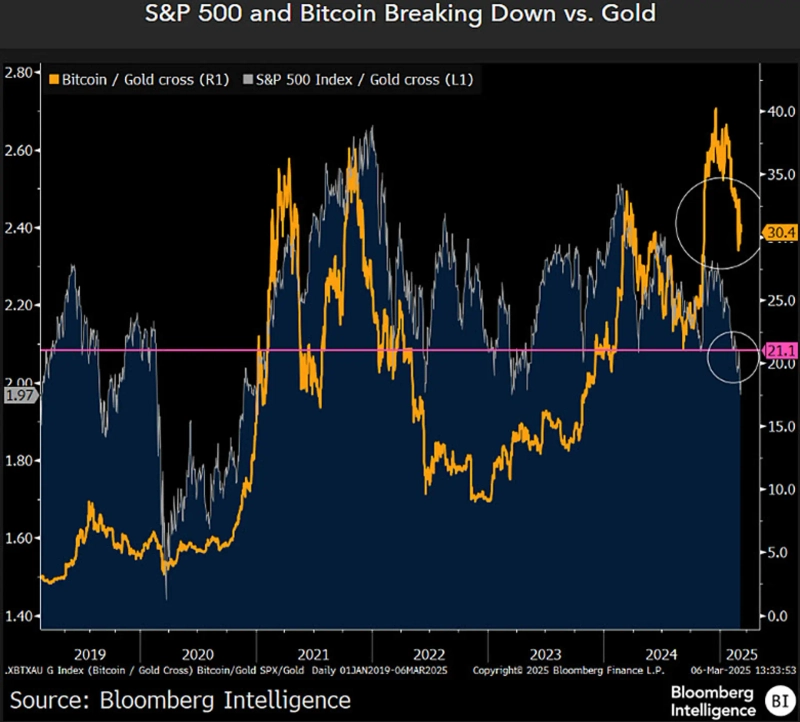

- "Bitcoin breaking through $100,000 this year could have similar implications to the NASDAQ index in 2000."

- "McGlone stated that Bitcoin's trend could become headwinds for risk assets and tailwinds for gold and US Treasury bonds."

- "He indicated that continued decline in the US stock market could be a major pressure factor for crude oil and copper prices."

Analysis suggests that this year's Bitcoin (BTC) chart shows similar patterns to the NASDAQ chart from 25 years ago.

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, stated on the 7th via X, "Bitcoin's breakthrough above $100,000 this year could have similar implications to when the NASDAQ index surpassed 5,000 in 2000." McGlone added, "This could create headwinds for risk assets while acting as tailwinds for gold and US Treasury bonds."

He also mentioned the recent downward trend in US stocks. McGlone said, "If the US stock market continues to decline, it could become a major pressure factor for crude oil and copper."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul