Summary

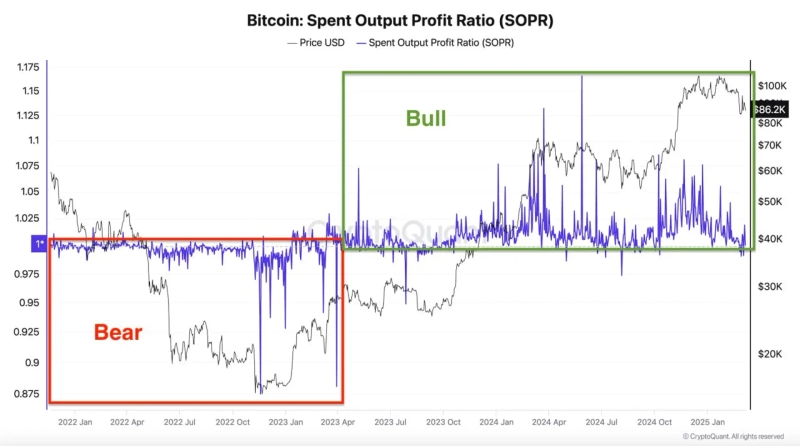

- "SOPR is reported to be a key indicator for distinguishing between Bitcoin bull and bear markets."

- "Contributor aytekin466 emphasized SOPR and funding rate as key reference indicators to determine whether the current Bitcoin market is in a bull phase."

- "The current trend of the funding rate is similar to the 2020-2021 bull market, and he stated that these indicators would need to fall below the critical level to confirm a change in market flow."

Analysis suggests that the perception of Bitcoin (BTC) being in a bull market is being tested.

On the 9th, CryptoQuant contributor aytekin466 stated, "(Bitcoin) is currently going through a period where the perception of a bull market is being seriously tested."

He emphasized that we should pay attention to 'SOPR (Spent Output Profit Ratio).' Aytekin466 explained, "SOPR is one of the key indicators that distinguishes between bull and bear markets," adding, "Generally in a bull market, investors realize profits, making SOPR greater than 1. From this perspective, it appears the bull market is still being maintained."

He also mentioned the funding rate. Aytekin466 said, "The funding rate is also a key indicator for identifying bull and bear markets," noting that "in a bull market, this ratio rarely becomes negative." He continued, "The current funding rate trend is similar to that of the 2020-2021 bull market," adding, "To be confident that the market trend has changed, SOPR and funding rates would need to fall below the 'critical level' more frequently than before."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul