[Analysis] "Bitcoin short-term holders facing $1 trillion in losses... Short-term decline expected due to increased selling pressure"

Summary

- Bitcoin short-term holders are selling with approximately $1 trillion in losses, leading to expectations of a short-term decline.

- The realization of losses by short-term holders increases selling pressure, raising the possibility of a Bitcoin price decline.

- This situation may provide long-term holders with opportunities for low-price purchases and could contribute to market stabilization.

Short-term holders who purchased Bitcoin within the last 1-3 months are selling at a loss, leading to expectations of a short-term decline.

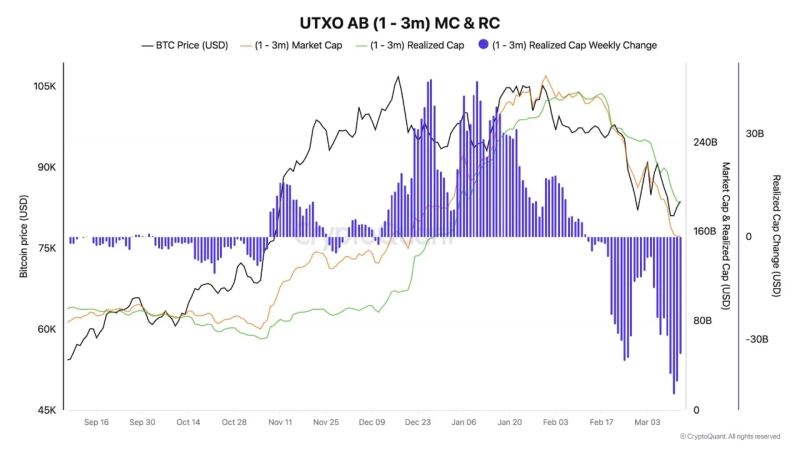

On the 13th (local time), CryptoQuant author onchained reported, "Short-term holders who purchased Bitcoin within the last 1-3 months have lost approximately $1 trillion in asset value since early February. Most of them bought at peak prices and are now selling as they cannot bear the losses."

The author continued, "The market capitalization of assets held by short-term holders (orange line) has fallen below their realized market capitalization (light green line). This signals that short-term holders are realizing their losses, which increases selling pressure and raises the possibility of a short-term Bitcoin price decline."

However, the author also suggested that the market's oversupply could be resolved through short-term holders' stop-loss selling, explaining, "The current situation may provide long-term holders with opportunities to buy at lower prices, which could ultimately contribute to market stabilization."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)