Summary

- Investors are reportedly shifting their focus from US stocks to other investment destinations such as Chinese and Hong Kong stocks.

- Investments in Chinese tech stocks and the safe asset gold are increasing, recording notable returns.

- Experts recommend diversifying portfolios to include European and Chinese stocks, while also keeping the potential for a rebound in the US market open.

Portfolio Adjustments by Investors

Korean Investors Sell $20 Billion in a Month

Switch to Chinese Tech Stocks like BYD and Xiaomi

Hang Seng Tech Index Up 30% This Year

Safe Asset Gold Purchases Surge

"Diversify into European and US Bonds"

Some Say "M7 and US Economy Still Strong"

Korean individual investors, who have been focused on the US stock market, are now looking at other investment destinations. This shift is due to the sharp decline in the S&P 500 and Nasdaq indices and growing concerns about an economic recession. Experts advise diversifying portfolios to prepare for a volatile market.

US Stock Holdings Fall Below $100 Billion

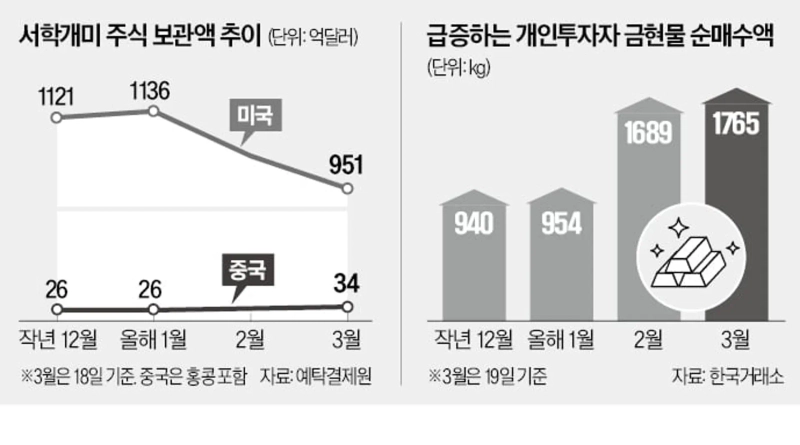

According to the Korea Securities Depository on the 20th, the US stock holdings of domestic investors were recorded at $95.1 billion (approximately 138.884 trillion won) as of the 18th. This is a 7.59% decrease from $102.9 billion a month ago. It is the first time in about four months since November last year that US stock holdings have fallen below $100 billion.

As the US stock market wavers this year, more individual investors are switching to other countries' stock markets. Interest in the Chinese stock market, which has been strong recently, is particularly high. The surge in Chinese tech stocks like Xiaomi, Alibaba, and BYD following the 'Deep Seek Shock' in AI has contributed to this interest. While the Nasdaq and S&P 500 indices have fallen by 7.94% and 3.29% respectively this year, the Hang Seng Tech Index, known as the 'Chinese Nasdaq,' has risen by over 30%.

Increase in Safe Asset 'Gold' Investments

The holdings of Chinese and Hong Kong stocks by domestic investors have surged from $2.6 billion in January to $3.4 billion (approximately 4.967 trillion won) currently. This is an increase of over 30% in just two months. The most held Chinese stocks are BYD ($310.98 million), Tencent ($243.44 million), and Alibaba ($198.4 million).

A private banker (PB) in Gangnam, Seoul, said, "Until last year, wealthy individuals were not interested in Chinese stocks," adding, "There has been a significant increase in inquiries about increasing the proportion of Chinese stocks this year." More investors are also paying attention to European stocks. As Germany and other European countries expand fiscal spending to stimulate the economy, investment sentiment has improved. The Euro Stoxx 50 Index, which consists of 50 leading companies in the Eurozone, has risen by 11.99% this year.

Many individual investors are also buying gold, a representative safe asset. According to the Korea Exchange, the amount of gold purchased by individuals this month (1st to 19th) reached 1,765 kg. The net purchase volume has been increasing every month, with 954 kg in January and 1,689 kg in February. Gold investment through exchange-traded funds (ETFs) is also active. Individual investors have net purchased 248.4 billion won worth of the 'ACE KRX Gold Spot' ETF this year. The return on this product is 12.64% this year.

As buying pressure increases, gold prices have also risen. On this day, the price of 1g of gold spot in the KRX gold market (closing price) was recorded at 144,980 won. It has risen by 12.6% in two months. Global investment banks (IBs) predict that gold prices could rise to $3,000 to $3,300 per ounce this year.

"Increase Proportion of European and Chinese Stocks"

Experts believe that the volatility in the US market will remain high for the time being. As President Donald Trump has announced the introduction of reciprocal tariffs on the 2nd of next month, it is expected that the tariff shock will continue to impact the stock market until the first half of the year.

In the securities industry, there are opinions that the proportion of Chinese and European stocks should be increased. Lee Young-joo, a researcher at Hana Securities, said, "The relatively neglected European and Chinese markets are being highlighted as alternative investment destinations," adding, "It is good to pay attention to Chinese tech stocks or European defense, AI, and pharmaceuticals," and "It is also worth considering allocating part of the portfolio to US high-yield bonds or collateralized loan obligations (CLOs)."

There is also an opinion that it is good to maintain the proportion of US stocks in the medium to long term. This is because the performance of US big tech companies and AI-related companies is solid, and the fundamentals of the US economy are still strong. Moon Nam-jung, a researcher at Daishin Securities, said, "As the perception that concerns about US economic growth were unfounded spreads, the New York stock market may rebound again after next month."

Yang Ji-yoon Reporter yang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.