Consumer Sentiment Freezes... Why Did Powell Say "The Economy is Fine" [Kim In-yeop's Macro Decode]

Summary

- Chairman Powell stated that the U.S. economy remains solid, but consumer sentiment is unstable due to recession concerns.

- According to Google Trends, while consumers are showing anxiety by frequently searching 'recession', hard data remains strong.

- UBS analyst warned that growing concerns about unemployment could pose a downside risk to U.S. economic growth.

Following Biden, the Trump Administration Also 'Vibe Session 2.0'

Powell "Hard Data is Solid" Dismisses Recession Possibility

Americans Search 'Recession' on Google Amid Tariff Fears

UBS "'Won't Get Fired' Sentiment Sustains Economy for 4 Years

Fear of Unemployment Brings Downside Risk to Growth"

"Consumer spending is slowing slightly but still maintaining a solid pace. The unemployment rate is 4.1%. ... Overall, it is a solid situation."

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), said this after keeping the benchmark interest rate unchanged at the Federal Open Market Committee (FOMC) on the 19th (local time). Despite growing concerns about a 'recession' due to President Donald Trump's tariff policy, he expressed confidence in the U.S. economy.

According to Google Trends on the 23rd, the frequency of Americans searching for 'recession' this month reached the highest level since 2022. Related searches include 'correction vs recession', 'Trump recession comment', and 'Nasdaq index'. This is interpreted as a result of President Trump's remarks on the 10th, when asked if he expected a recession, saying "There is a transition period in such matters," which did not rule out the possibility of a recession, causing investor anxiety.

Chairman Powell dismissed these concerns, saying, "The probability of a recession forecasted by institutions has risen, but the possibility is still low." He explained, "We cannot ignore that soft data has deteriorated, but for now, hard data remains solid."

According to the St. Louis Federal Reserve, hard data refers to data compiled and released by national institutions, such as consumption, government spending, investment, and inventory, which make up the Gross Domestic Product (GDP). Soft data includes subjective evaluations such as business and consumer sentiment surveys. In other words, while people's sentiment is somewhat uneasy, Chairman Powell argued that the fundamentals of the real economy are solid.

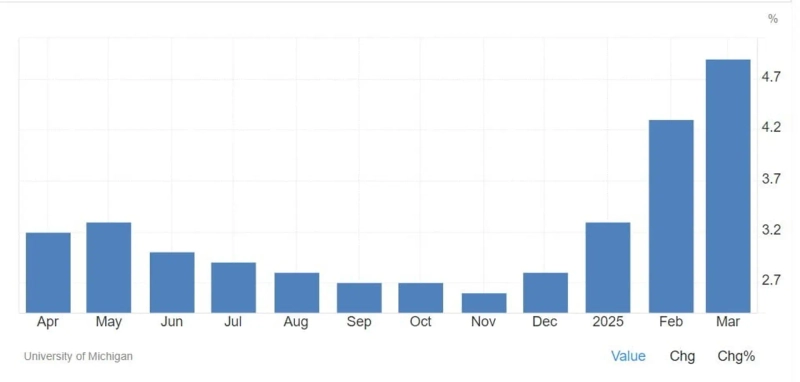

U.S. soft data has recently been on a sharp decline. The University of Michigan Consumer Sentiment Index, a representative indicator of economic sentiment, was 57.9 on the 14th, significantly below the forecast of 63.1. It dropped 15.3 points in two months. A score above 100 means respondents expect the economy to be good, while below 100 means they expect it to worsen.

On the other hand, the 'hard data' mentioned by Chairman Powell are the unemployment rate and Personal Consumption Expenditures (PCE), which represent the labor market and prices (consumption), respectively. The U.S. unemployment rate in February was 4.1%, lower than the historical average of 5.68%. The PCE inflation rate in January was 2.5% (year-on-year), not far from the Fed's inflation target of 2%, according to Chairman Powell.

Chairman Powell also expressed concern, saying, "Short-term indicators of inflation expectations have risen." On the 14th, the University of Michigan announced that the 1-year expected inflation rose by 0.6 percentage points to 4.9% compared to February, which is interpreted as being taken into account.

However, Chairman Powell said, "If inflation is a temporary phenomenon expected to disappear quickly without Fed action, it may be appropriate to just observe such inflation," adding, "Tariff inflation may fall into this category." If the price rise is due to consumers or businesses rushing to buy goods out of tariff concerns, a hasty rate hike could actually harm the economy.

As Chairman Powell pointed out, the gap between the real economy and the economic sentiment of American citizens is rapidly widening. Bloomberg News described this as 'Vibe Session 2.0'. Vibe Session refers to a situation where people perceive the economic situation pessimistically, contrary to the actual economic situation. It is a term that emerged when the U.S. economy achieved 'solo growth' during the previous Joe Biden administration, but consumers struggled due to soaring prices.

Is soft data important? Is hard data important? For now, Wall Street seems to side with the saying, "The economy is psychology." UBS analyst Paul Donovan pointed out, "Low fear of unemployment has sustained the economy for the past four years," adding, "If uncertainty begins to trigger fear of unemployment, greater downside risks to U.S. growth will emerge." Bloomberg News added, "Even if you haven't lost your job yet, if there's worry about unemployment, people will start to reduce spending to prepare for risks."

[Macro Decode is content that deals with global macroeconomic issues such as interest rates, exchange rates, growth, and labor markets in an easy-to-understand manner. For more easy and in-depth economic articles, please subscribe to the reporter's page.]

Reporter Kim In-yeop inside@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.