Summary

- It was reported that the US economy and stock market are stalling due to President Donald Trump's all-out tariff policies.

- The simultaneous weakness of the US dollar and stock market is something that has rarely happened in the past 25 years, and capital movement to Europe and China is accelerating.

- Doubts about American Exceptionalism are increasing due to the downward revision of the US economic growth forecast and signs of economic recovery in Europe.

US Economy Stalls Amid Growing Uncertainty…Global Funds Also Withdraw

Dollar and Stock Market Both Sluggish

Dollar Index from 109 in January to 104 This Month

S&P500 Down 3.6% Compared to Early Year

Unusual Dollar Sell-off + Stock Market Adjustment

'Money Move' to Europe and China

$2.2 Billion to European Stock ETFs Last Month

China's Stimulus Effect … Hang Seng Index Up 18%

Wall Street Also Questions 'American Exceptionalism'

The US economy and stock market, which had been running solo, are stalling. Since President Donald Trump embarked on an all-out tariff war after taking office, concerns about an economic downturn have grown, and the stock market is losing momentum. Earlier this year, 'American Exceptionalism' was prevalent on Wall Street, but the situation has changed now. The US dollar is also weakening, and global funds that were flowing into the US are turning towards Europe and China. American exceptionalism is shaking.

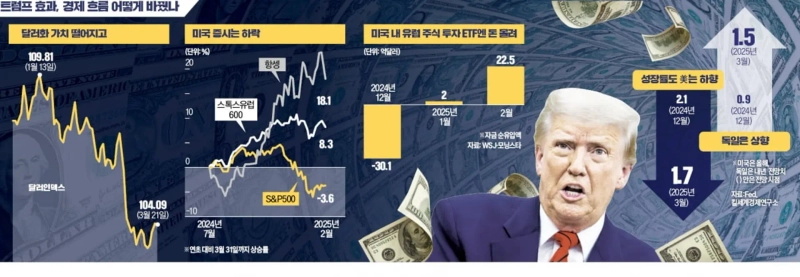

The uncertain US economic situation is evident in various indicators. The dollar index, which represents the value of the dollar against the currencies of six major countries, fell to 103.95 at one point on the 24th. Compared to 109.35 on January 20, when President Trump took office, it has decreased by 4.9%. The strong dollar trend before Trump's second term has been broken. On the other hand, the euro, which was once weak with concerns that it would fall below 1 dollar per euro, is now strong. It recently rose to 1.8 dollars per euro.

The stock market shows more mixed results. The S&P500 index, a representative index of the US stock market, fell by 3.6% as of the 21st this year. Although it rose by more than 23% last year, it is losing momentum this year. In contrast, the Stoxx Europe 600, composed of the top 600 companies by market capitalization in Europe, rose by 8.3% this year, and the Hong Kong Hang Seng Index jumped by 18.1% due to China's economic stimulus measures. The 'Magnificent 7', including Apple, Microsoft (MS), Nvidia, and Meta, which dominated the global stock market last year, are also struggling this year. The Financial Times (FT) reported that the simultaneous weakness of the US dollar and the US stock market is something that has rarely happened in the past 25 years.

To make matters worse, signs of 'de-Americanization' are appearing in the capital market. According to the Wall Street Journal (WSJ) and Morningstar, exchange-traded funds (ETFs) that mainly invest in European stocks within the US saw capital outflows every month in the second half of last year, but this year, there was a net inflow of $200 million in January and $2.25 billion in February. This is analyzed as a result of concerns about the US economic slowdown and the uncertainty of tariff policies.

US macroeconomic indicators are also deteriorating. The US Federal Reserve (Fed) lowered its US economic growth forecast for this year from 2.1% to 1.7% due to uncertainty from President Trump's tariff policies. In contrast, Germany, the largest economy in Europe, is showing signs of recovery thanks to large-scale fiscal expansion. Germany has decided to invest 500 billion euros (about 790 trillion won) in government finances in infrastructure over the past 12 years and to amend the constitution to allow virtually unlimited increases in defense spending. This is a response to President Trump's 'America First' policy, which has shown a step back from European defense. The Kiel Institute for the World Economy in Germany raised Germany's economic growth forecast for next year from 0.9% to 1.5%, citing that fiscal expansion will help stimulate the economy.

The atmosphere on Wall Street, which emphasized American exceptionalism, is also changing. Goldman Sachs evaluated in an investment report last week that "doubts about the sustainability of American exceptionalism have increased in recent weeks, triggering the fastest US stock market adjustment since the early 1970s."

New York = Shin-Young Park, Correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.