Exchange rate surpasses 1470 won during the day... "Weak won expected for the time being"

Summary

- The won-dollar exchange rate surpassed the 1470 won level for the first time in 50 days, and it is analyzed that the weak won situation will continue for the time being.

- Experts stated that political uncertainty, such as the delay in President Yoon Suk-yeol's impeachment trial, is a major factor in the rising exchange rate.

- It is predicted that the exchange rate could rise to 1490 won in the short term, and despite the intervention of foreign exchange authorities, the rate of decline is not expected to be rapid.

Exchange rate becomes unstable again ... Rising for 6 consecutive trading days, foreign exchange authorities intervene to defend 1460 won level

Increased demand for dollars due to institutional and individual overseas investments

Heightened anxiety due to delay in President Yoon's impeachment trial

"Could jump to 1490 won in the short term"

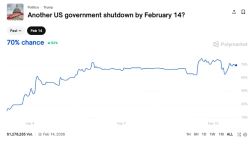

The won-dollar exchange rate surpassed the 1470 won level during the day for the first time in 50 days. Analysts say that the weak won (rising exchange rate) trend continues due to increased political uncertainty as the verdict on President Yoon Suk-yeol's impeachment trial is delayed, along with a preference for global safe assets due to the strong dollar.

On the 25th, the won-dollar exchange rate in the Seoul foreign exchange market (as of 3:30 PM) closed the weekly trading at 1469 won 20 jeon, up 1 won 50 jeon from the previous day. It has been rising for 6 consecutive trading days on a weekly basis. On this day, the exchange rate slightly increased reflecting the strong dollar atmosphere right after the market opened, and reached a high of 1471 won 10 jeon around 11:20 AM. It is the first time in about 50 days since the exchange rate exceeded 1470 won in weekly trading since the 3rd of last month (1472 won 50 jeon). Experts believe that the foreign exchange authorities intervened in the market on this day.

The market analyzed that the political uncertainty due to the delay in President Yoon's impeachment verdict is dragging down the value of the won. Lee Min-hyuk, a researcher at Kookmin Bank, said, "In the current market atmosphere, the won seems to be more affected by domestic political issues." Min Kyung-won, an economist at Woori Bank, said, "Since March, the global weak dollar trend has appeared, and only the Turkish lira and Korean won, which are experiencing political uncertainty issues, have significantly depreciated," adding, "In the options market, bets on rising exchange rates have increased again as the impeachment verdict was delayed until the end of March." Park Sang-hyun, a researcher at iM Securities, predicted, "It could rise to 1490 won in the short term."

The strong dollar due to the favorable U.S. service industry indicators the previous day and the selling trend of foreign investors in stocks were also analyzed as factors that caused the exchange rate to rise on this day. The dollar index, which shows the value of the dollar against the currencies of six major countries, was 104.330 as of 3:30 PM, up 0.07% from the previous day.

Experts believe that even after the political uncertainty such as President Yoon's impeachment is resolved, the exchange rate is unlikely to fall rapidly. This is because the trade policies of the Donald Trump U.S. administration act as a factor for the weak won, and structural factors such as the increase in overseas investments by domestic institutions and individual investors also affect the exchange rate. The reciprocal tariffs of the Trump administration, scheduled for the 2nd of next month, are mentioned as a major variable that will directly affect the value of the won. The global preference for safe assets is also a burden on the won. Kwon A-min, a researcher at NH Investment & Securities, predicted, "The won-dollar exchange rate is likely to fall after the impeachment verdict, but the decline will be limited." It is explained that the structural increase in overseas investments by domestic investors supports the lower bound of the exchange rate.

Woori Bank predicted that the won-dollar exchange rate would fall to 1410 won in the second quarter, 1390 won in the third quarter, and rebound to 1430 won in the fourth quarter. Citi predicted that if the impeachment verdict comes out at the end of this month to early April, the exchange rate will remain in the 1450 won range for about three months and then gradually fall to around 1435 won. NH Investment & Securities forecasted a gradual decline from 1430 won in the first quarter to 1360 won in the fourth quarter.

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.