"Ridiculous Report" Laughed Off... Global 'Emergency' Due to Trump Shock [Lee Sang-eun's Washington Now]

Summary

- The "Miran Report" suggests ways to restructure the global trade system, addressing the strong dollar issue and proposing specific methods to maintain the U.S.'s key currency status.

- The report proposes that the Trump administration's tariff policies and a multilateral agreement for a new international financial order aim to revive the U.S. manufacturing industry and support shared burdens among allies.

- Experts express concerns that these measures could threaten the international position of the dollar or accelerate the decline of U.S. global leadership in the long term.

Increasing Possibility of 'Mar-a-Lago Agreement'

'Detonator' Shaking the Global Financial Market

One of the hot topics on Wall Street recently is the 'Miran Report.' It refers to the 'Global Trade System Reconfiguration User Guide' released by Steven Miran, a member of the U.S. White House Council of Economic Advisers (CEA), in November last year as a macro strategist at Hudson Bay, an investment advisory firm, following the election of President Donald Trump.

The 41-page report in the form of a small thesis released by Miran immediately became a topic of conversation for its boldness. It contains a plan to completely restructure the global financial order that the U.S.-centered world has built since World War II. The report, which proposes a structure to share costs with allies to maintain the dollar's status as the world's key currency while resolving the structural strong dollar, suggests using tariffs to pressure allies.

In the early days of the Trump administration, the Miran Report was evaluated as 'impractical' and 'ridiculous.' Now it's different. Over the past two months, it has been taken seriously as a report explaining the meaning of the Trump administration's tariff policies and somewhat ambiguous economic, trade, and diplomatic strategies, and providing a blueprint for the new world order they envision.

Reinventing the Global Exchange Rate Management System

The Miran Report finds the cause of the sluggish U.S. manufacturing industry in the structural strong dollar. It states that "because dollar assets play the role of the world's key currency," the demand for the dollar increases excessively, which "reduces the competitiveness of U.S. exports, makes imports cheaper, and harms U.S. manufacturing." It diagnoses that "factories close, manufacturing employment decreases, leading to government subsidies or drug addiction."

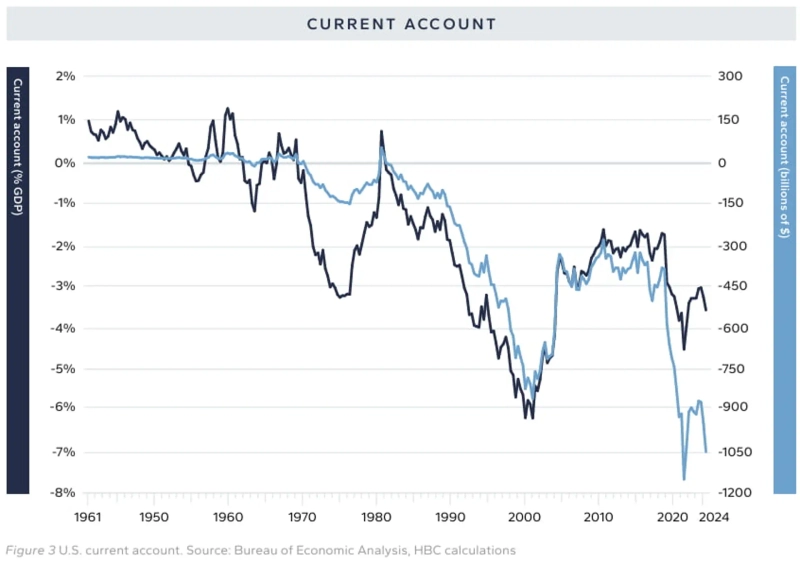

Generally, countries with trade and fiscal deficits see their currency values decrease, leading to increased exports and a return to balance, but the U.S. is an exception. Because it provides reserve assets to the world, there is demand for U.S. dollars (USD) and U.S. Treasury securities (UST) no matter how large the trade and fiscal deficits are. U.S. exports are not airplanes or cars like other countries. They are U.S. Treasury securities. The U.S. economy is in a dilemma (Triffin's dilemma) of having to sustain a continuous current account deficit by selling (exporting) Treasury securities to other countries and accepting their goods (importing) in return.

As the U.S. economy's share of the world decreases, the 'pain' in the U.S. export sector due to the supply of reserve currency becomes much stronger, according to his analysis. According to the World Bank, the share of U.S. GDP in the world's total production (GDP) has shrunk from 40% in the 1960s to 26% now. Although the use of other currencies such as the euro and yuan has increased during this period, the status of the dollar remains overwhelming. The report explains, "As the share of U.S. GDP relative to world GDP decreases, the size of the deficit the U.S. has to bear to support global trade and savings is increasing," and "the growth of the world is increasing the pain on U.S. exports."

At this point, he advances the argument that the exchange rate management system itself needs to be reinvented. The Miran Report explains that the Trump administration "can seek ways to reclaim some of the benefits that other countries receive through our provision of reserves, rather than ending the use of the dollar as a global reserve currency."

The Goal is Threefold

The Miran Report does not aim for a single conclusion but presents several bold ways to resolve this situation. The goals are threefold: to resolve the structural strong dollar, revive U.S. manufacturing, and at the same time maintain the U.S.'s status as a key currency and hegemonic nation. The reason past U.S. administrations have not been able to do this is that these three goals conflict. In particular, it doesn't make sense for a key currency supplier to pursue a weak currency. No one buys something expected to decrease in value.

Miran proposes using the status of the U.S. as a huge consumer market and security leadership to jointly impose this burden on allies. One of them is the so-called 'Mar-a-Lago Agreement.' It demands allies to forcibly convert their short-term Treasury securities of less than 10 years into, for example, 100-year maturity bonds. The key is to issue these ultra-long-term bonds at almost zero interest.

If allies buy ultra-long-term bonds at almost zero interest, the U.S. can maintain the dollar's status as a key currency without the burden of interest. In this process, the dollar holdings of each country decrease, lowering the dollar's value, and the currency value of participating allies rises. Participating countries have to bear the risk of long-term interest rate fluctuations (bond price fluctuations), which can be resolved through currency swaps with the U.S. Federal Reserve or Treasury.

He wrote, "Trade partners will bear more of the global security resources, total demand will be redistributed to the U.S., and U.S. taxpayers can redistribute interest rate risks to foreign taxpayers." This Mar-a-Lago Agreement is akin to the act of changing the principles of the financial system by the U.S., which is caught in Triffin's dilemma, and is comparable to President Richard Nixon's suspension of gold convertibility in 1971 when trade deficits became excessive. In terms of a 21st-century version of a multilateral currency agreement, it also reminds one of the 1985 Plaza Accord.

Tariff Pressure, Prelude to Forcing 100-Year Bonds?

The question is whether other countries will participate in such an agreement. There are few ways to make allies participate willingly without twisting their arms. The stick and carrot to enforce this is tariffs. To reduce tariff burdens and share the U.S. security umbrella, they are asked to share the cost of issuing key currency.

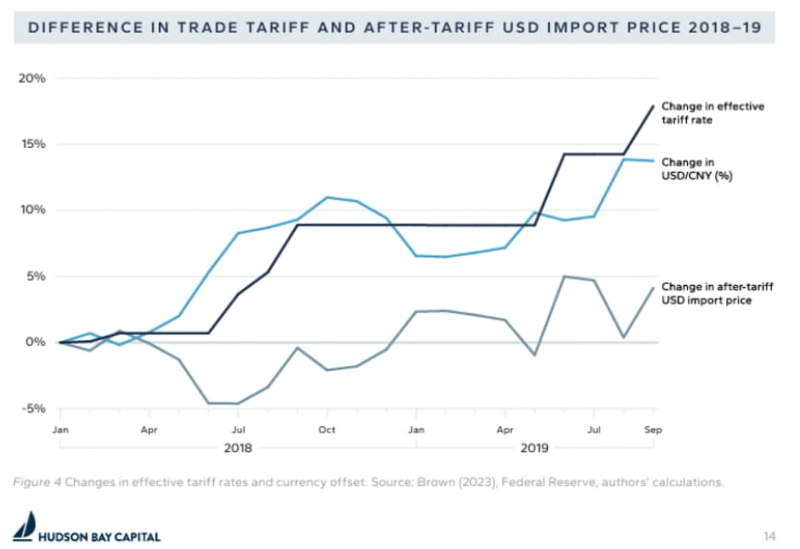

Economists point out that the cost burden of tariffs is high. Prices rise, and ultimately U.S. importers and citizens have to pay the costs. Miran's view is different. As long as other countries cannot easily give up the U.S. market, the tariff burden can remain more on foreign countries than on U.S. citizens. Also, when tariffs were imposed on China during Trump's first term, the inflation effect was offset by the rise in the dollar's value, supporting his view that the cost of tariff policies may not be as high as expected. He suggested an appropriate tariff rate that the U.S. can bear at 20%. He believed that even if tariffs rise to ten times the current level (around 2%), it would not significantly harm the U.S. economy.

Trump's strategic behavior of imposing higher tariffs on allies than on adversaries, claiming that allies are 'ripping off' the U.S., and maximizing the pressure by announcing sequentially higher tariffs is quite strategic.

The report also mentions ideas such as charging foreign central banks for using dollars or imposing taxes on foreign investments, in addition to the 100-year zero-interest bonds. Miran recently appeared on Bloomberg TV and described the report as a 'recipe book' offering various options to President Trump. He did not rule out the possibility of a multilateral currency agreement but emphasized that the Trump administration is "currently focusing on tariffs."

Who Will Participate?

The feasibility of this report, which the author himself believes signifies a change in the global market as significant as the Bretton Woods system and its end, remains uncertain. Above all, it cannot be guaranteed that major allies will willingly participate in this system just because a carrot-and-stick strategy using tariffs is employed.

Brad DeLong, a professor at UC Berkeley, pointed out, "For a deal to be struck, the counterpart must believe that the deal will be honored, but President Trump confirms daily that he is not that kind of person." It is also problematic that it is difficult to be sure whether the U.S. will permanently continue President Trump's policies.

Amid growing international backlash against unilateral tariff impositions and diplomatic policies, the U.S. attempting to reorganize the global financial system could shake the very status of the U.S. as an empire. As economic zones reorganize around the yuan or euro, the status of the dollar could fall instead. Jeffrey Frankel, a professor at Harvard University, warned that this plan resembles the Roman Empire's demand for tribute from occupied territories, saying, "It could damage the U.S.'s ability to finance itself and threaten the dollar's status as a major international currency, accelerating the decline of U.S. global leadership."

There are also criticisms that the core cause of the strong dollar is missing. Martin Wolf, a columnist for the Financial Times (FT), pointed out that the cause of the strong dollar should not be found solely in the demand for key currency, citing the chronic lack of savings in the U.S. as one cause. He explained that the excessively low savings compared to the investment scale in U.S. companies leads to current account imbalances and further strengthens the dollar (as investment funds flow into the U.S.). To resolve this, a savings rate increase of more than 3% of GDP is needed, but the Miran Report does not mention this issue, he criticized.

Washington Correspondent Lee Sang-eun

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.