Won-Dollar Exchange Rate Hits Highest Since Financial Crisis…"Possibility of Surpassing 1500 Won"

Summary

- The won-dollar exchange rate has reached its highest level since the financial crisis, raising the possibility of surpassing 1,500 won.

- Amid economic concerns due to the discussion of universal tariffs, the weakness of the Korean won is said to be continuing.

- Experts are considering the possibility of further depreciation of the Korean won, as the interest rate gap affects the exchange rate.

The won-dollar exchange rate has soared to its highest level since the 2009 global financial crisis. This is due to renewed concerns about the fundamentals of the Korean won following the resumption of short selling.

On the 31st, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1,472.90 won, up 6.40 won from the previous session.

Starting the day at 1,470.60 won, the won-dollar exchange rate showed a trend of gradually increasing its peak. The closing price for the day is the highest in 15 years and 9 months since March 13, 2009 (1,483.50 won).

With short selling in the domestic stock market resuming after a 1 year and 5 month ban, concerns about the fundamentals of the domestic economy seem to have dragged down the value of the won. Jeong Yong-taek, a researcher at IBK Investment & Securities, explained, "Economic concerns are growing as news spreads that the Trump administration is discussing universal tariffs. This is because Korea is a country with high trade and U.S. dependency."

The Trump administration plans to impose reciprocal tariffs on all countries, including Korea, starting from the 2nd of next month. In addition to reciprocal tariffs, there is speculation that a 'universal tariff' of up to 20% on all imports could be introduced.

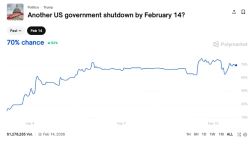

Experts expect the weakness of the won to continue for the time being. Considering the interest rate gap between Korea and the U.S., there is also an analysis that the won-dollar exchange rate could surpass 1,500 won. Researcher Jeong diagnosed, "The key factor moving global exchange rates is the 'interest rate gap,'" adding, "It is difficult for the interest rate gap between Korea and the U.S. to narrow easily."

He also predicted, "In the past, when the U.S. imposed tariffs on China, China countered by devaluing the yuan. If such a move occurs again, the won-dollar exchange rate could also surpass 1,500 won."

Jin Young-gi, Hankyung.com reporter young71@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.