Summary

- The Trump administration in the US has formalized Bitcoin reserves, but due to macroeconomic uncertainty from the tariff war, Bitcoin prices are stagnating at the 120 million won level.

- Although GameStop announced plans to purchase Bitcoin, concerns about a US economic recession have prevented a price rebound.

- The Trump administration is focusing on stablecoins to strengthen the dominance of the dollar, and a bill has been introduced to prohibit the Fed from issuing CBDC.

Uncertainty Grows with Expanding Tariff War

Stays Over 120 Million Won for Over 20 Days

US Administration "Strengthening Dollar Hegemony" Stance

Trump Family Issues Stablecoin

Despite positive news in the virtual asset market, such as the Trump administration formalizing Bitcoin reserves, Bitcoin prices are stagnant. This is due to increased macroeconomic uncertainty from the US-led tariff war. With ongoing inflation concerns in the US, there is a forecast that the Bitcoin market will also show mixed trends.

◇ Bitcoin on a Roller Coaster

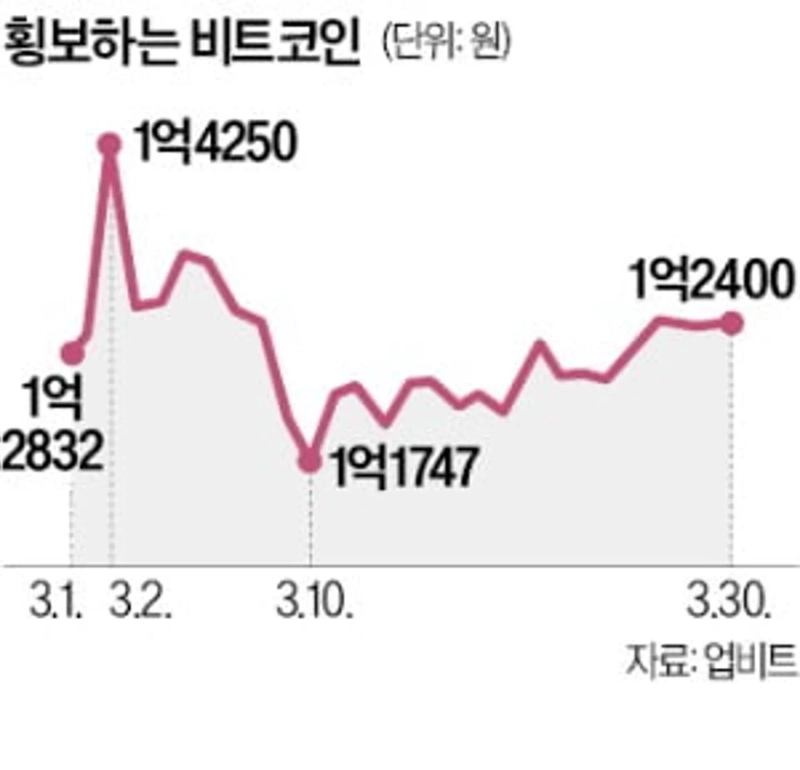

According to the domestic cryptocurrency exchange Upbit on the 1st, Bitcoin has been trading over 120 million won for more than 20 days. It attempted a rebound by surpassing 140 million won early last month but experienced high volatility, falling to the 110 million won range. It has since recovered to the 120 million won range. In the global market, it once fell to the 70,000-dollar range but is trading in the 80,000-dollar range.

The roller coaster ride of Bitcoin prices is due to simultaneous occurrences of good and bad news in the market. On the 2nd of last month (local time), President Trump announced that cryptocurrencies such as Bitcoin, Ethereum, XRP, Solana, and ADA would be reserved as 'strategic reserves.' This means preparing virtual assets for emergencies, similar to major energy sources like oil. It implies that the US government will not sell cryptocurrencies seized from criminals but will continue to hold them. It is reported that the US government holds about 200,000 Bitcoins. President Trump stated on social media, "The US reserves will elevate the virtual asset industry, which is in crisis after years of corrupt attacks by the Biden administration," and "This is why I instructed the working group to pursue strategic reserves for digital assets through an executive order." Upon this news, Bitcoin rose by nearly 10%.

◇ GameStop Plans to Purchase, But...

Although President Trump subsequently signed an executive order to strategically reserve Bitcoin, the price of Bitcoin fell instead. This is because the US government stated it would not purchase virtual assets with taxes. This was disappointing news for the market, which expected the US government to buy Bitcoin directly.

News that US game distributor GameStop would purchase Bitcoin was reported, but it did not affect the rebound of Bitcoin prices. GameStop announced on the 26th of last month that it unanimously approved adding Bitcoin to its balance sheet. Upon this news, GameStop's stock price rose by more than 8% in after-hours trading. GameStop currently holds liquid assets worth 5.4 billion dollars (about 7.8 trillion won). However, GameStop did not disclose how much it would invest in Bitcoin.

Despite the favorable news from GameStop, Bitcoin prices did not gain strength due to growing concerns about a US economic recession. As the US engages in a tariff war, the forecast that it will stimulate inflation is becoming a reality. With President Trump signing an executive order imposing a 25% tariff on foreign cars, there is speculation that this will lead to price increases. If this happens, it could disrupt the Federal Reserve's (Fed) plan to cut interest rates. The cryptocurrency market is generally heavily influenced by interest rate policies. Although the Fed has announced its intention to cut rates twice within the year, rate cuts may be delayed if prices rise. CoinDesk, a cryptocurrency-focused media outlet, analyzed, "While the digital asset summit at the White House and President Trump's executive order on Bitcoin strategic reserves have already been announced, the cryptocurrency market is not finding short-term positive momentum," and "Instead, concerns about the tariff war and economic slowdown are weighing on investor sentiment."

Standard Chartered (SC) expressed the opinion that Bitcoin is closer to a type of tech stock rather than 'digital gold.' Jeff Kendrick, SC's Global Head of Digital Asset Research, advised, "Cryptocurrencies like Bitcoin are being treated more as a type of tech stock rather than a risk-hedging tool," and "Investing with this mindset will make investing easier."

◇ "Will Strengthen Dollar Dominance"

Meanwhile, the Trump administration is focusing on stablecoins to strengthen dollar hegemony. In a speech at the digital asset conference on the 20th of last month, President Trump argued, "Dollar-based stablecoins will contribute to further strengthening the dominance of the dollar." US Treasury Secretary Scott Besant also expressed his stance to utilize stablecoins to strengthen the global dominance of the dollar. The Trump family has decided to issue its own stablecoin. World Liberty Financial, a cryptocurrency service company established by the Trump family, announced the launch of its own stablecoin, USD1.

In the US Congress, a bill has been submitted to prohibit the Fed from issuing a central bank digital currency (CBDC). US Senator Ted Cruz introduced the 'CBDC Anti-Surveillance State Act,' which prohibits the Fed from providing CBDC-related products and services to Americans. CBDC is considered an alternative to stablecoins, which are digital forms of legal currency and have a one-to-one value linkage with specific assets (mainly dollars).

Reporter Jo Mi-hyun mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.