Summary

- It was reported that due to concerns over the US-initiated tariff war, funds are rapidly moving to safe assets like gold, bonds, and cash.

- It was revealed that $19.2 billion flowed into global gold ETFs in Q1, marking the largest since COVID.

- The US stock market has declined due to concerns over the trade war and economic slowdown, and as a result, defensive stocks are relatively strong.

"Fear of Unpredictable Market"…Funds Move to Safe Havens

Gold Prices Jump 17% This Year to 'All-Time High'

Q1 ETF Inflows Largest Since Pandemic

Fund Managers Increasing Cash Holdings

US 10-Year Treasury Yield Hits Year Low

Q1 Stock Market 'Worst in 2.5 Years'

Defensive Stocks Like Insurers 'Holding Up'

As concerns grow that the US-initiated tariff war will shock the global economy, a trend of 'safe asset refuge' is spreading in financial markets. Investor funds are rapidly moving to gold, bonds, and cash.

◇ Gold ETF Inflows Largest Since COVID

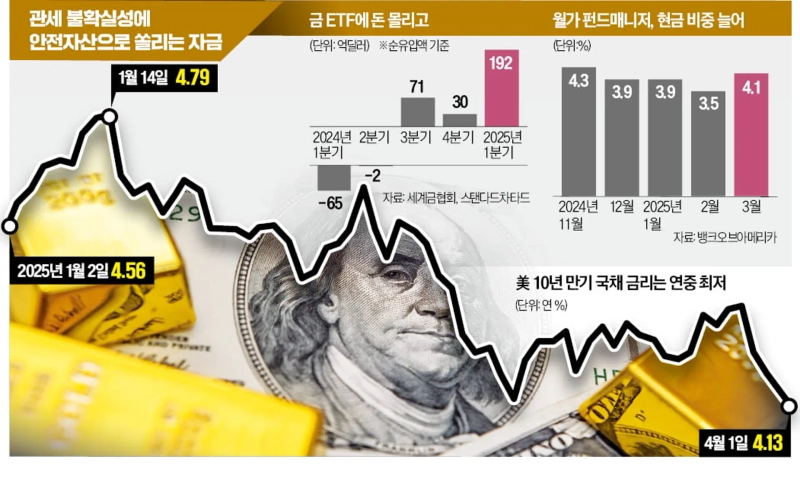

According to Standard Chartered Bank on the 1st (local time), $19.2 billion (about 28 trillion won) flowed into global gold exchange-traded funds (ETFs) in Q1 this year. This is more than six times the net inflow of $3 billion in Q4 last year before Donald Trump took office and the largest since Q2 2020 when the COVID-19 pandemic began. In Q1 last year, there was a net outflow of $6.5 billion.

In the past, central banks of various countries led gold purchases. Recently, even individuals who are reluctant to invest in stocks due to market instability are flocking to gold ETFs. Krishan Gopaul, an analyst at the World Gold Council, said, "Uncertainty is one of the factors that has rekindled interest in gold," adding, "There is a general risk-averse sentiment in the market." The decline in the US stock market, inflation concerns due to Trump tariffs, and the possibility of an economic recession are analyzed to be stimulating demand for gold, a safe asset.

Amid the preference for gold, the price of gold reached an all-time high of $3,148.88 per troy ounce on this day. Gold prices have risen more than 17% this year. It is the highest quarterly growth rate in about 40 years. Macquarie expects gold prices to rise to $3,500 per troy ounce this year.

◇ Cash and Bonds Also Safe Havens…Spreading to Europe

The caution against market uncertainty is also detected in the increased cash holdings of institutional investors. According to a survey by Bank of America (BoA) of 205 fund managers managing $477 billion, the cash proportion in their portfolios jumped from 3.5% in February to 4.1% in March. This is the highest since March 2020. Investors are accumulating cash at a pace similar to during COVID-19.

The price of US Treasury bonds, a representative safe asset, is also on the rise. The yield on the 10-year US Treasury fell to 4.13% during the day (bond price rise), marking the lowest level this year. Sunil Krishnan, head of multi-asset at Aviva Investors, said, "With the possibility of a US economic slowdown added to tariffs, Treasuries are emerging as an attractive risk mitigation tool." Barclays predicts that "the trend of selling US stocks and buying Treasuries will continue even after the tariff announcement."

The buying trend of Treasuries is also spreading to the European market. The yield on the 10-year German government bond, a representative safe asset in the Eurozone, which had rebounded due to the German government's large-scale fiscal spending plan announcement, fell below 2.7% again in a month.

◇ Defensive Stocks Strong in Stock Market

Amid concerns over the deepening trade war, the US stock market in Q1 experienced the worst slump in 2.5 years. The S&P 500 index fell 4.6% and the Nasdaq index dropped 10.4% in Q1, marking the largest decline since Q3 2022. There is a pervasive atmosphere of pessimism in the market.

BoA diagnosed that "concerns about stagflation, trade war, and the weakening of the US's unique position have triggered the collapse of the bull market." In the BoA survey, expectations that the global economic growth rate will decline rose from 2% in February to 44% in March.

Recently, the stocks showing an upward trend in the stock market are mainly defensive stocks like insurers. While the S&P 500 index fell 3.7% over the past month, UnitedHealth rose about 12% and HCA Healthcare increased by 11%. Pete Drewienkiewicz, Chief Investment Officer (CIO) at Redington, said, "There are hardly any attractive assets at the moment," adding, "It is not surprising that investors are moving defensively after the market has risen strongly."

Reporter Da-yeon Lim allopen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.