Summary

- Trump's reciprocal tariff measures are expected to cause significant changes to the global trade system and threaten approximately $33 trillion worth of trade, according to Bloomberg.

- The U.S. Gross Domestic Product (GDP) is analyzed to decrease by 4% in the worst-case scenario, with consumer prices rising by about 2.5%.

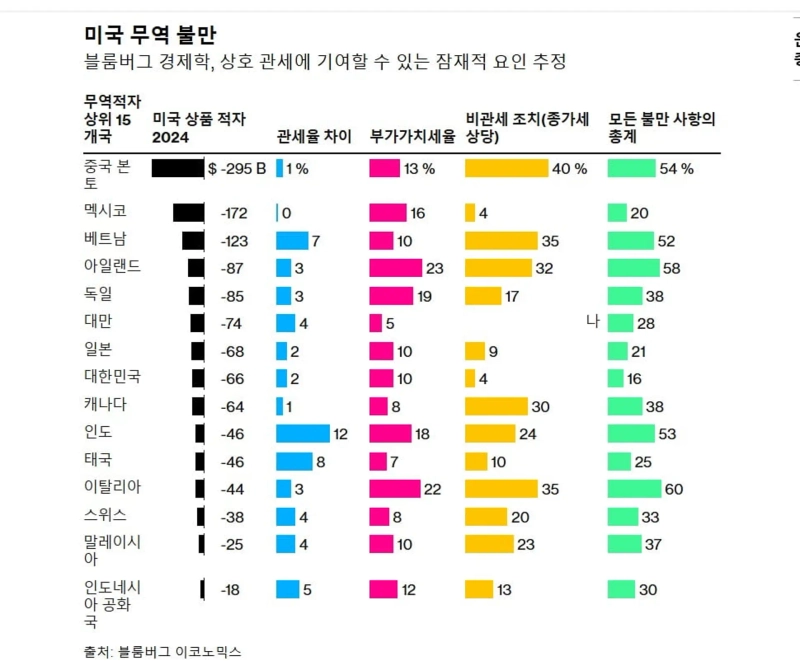

- An analysis of dissatisfaction scores between the U.S. and its trade partners showed that Korea has the lowest trade dissatisfaction score, indicating relatively less impact.

Decrease in Exports to the U.S. by 4% to 90% by Country

"Korea Has the Lowest Dissatisfaction Index Among 15 Countries Based on Tariff and Non-tariff Barriers"

U.S. GDP Hit by 4% and Consumer Prices Rise by 2.5%

Trump's reciprocal tariffs have overturned the global trade system and ushered in a new era of risk for the global economy.

The global trade volume at risk due to Trump's tariffs is approximately $33 trillion (4,830 trillion won), and exports to the U.S. by country are predicted to decrease by at least 4% to 90%. Additionally, the U.S. GDP is estimated to be hit by 4% in the worst-case scenario, with consumer prices rising by about 2.5% over the next 2-3 years.

According to Bloomberg on the 2nd (local time), the reciprocal tariffs Trump will announce today are the most extensive trade restrictions in U.S. history since the 1800s. As a result, Bloomberg expects it to pose unpredictable risks to the global economy.

Bloomberg Economics estimates the trade volume affected by Trump's measures to be about $33 trillion (4,830 trillion won). It is expected that exports to the U.S. from countries ranging from Brazil to China will decrease by about 4% to 90% by country. The World Trade Policy Uncertainty Index has soared to its highest level on record since the 2009 global financial crisis.

The average U.S. tariff rate is expected to rise by up to 28 percentage points in the worst-case scenario. This could hit the U.S. GDP by 4% and raise consumer prices by about 2.5% over the next 2-3 years.

Economists at Goldman Sachs also stated that the average U.S. tariff on all countries is likely to rise by 15 percentage points this year. They warned that this would increase core inflation in the U.S., weaken growth, and heighten the risk of recession.

According to data from the Federal Reserve Bank of St. Louis, the share of imports, including goods and services, contributing to the U.S. GDP was 14% last year. This is three times the 4.5% level of GDP contribution from imports during the protectionist era of the 1930s in the U.S.

Many economists have warned that the tariff war will ultimately harm the U.S. economy, but it was 'like reading to a cow's ear' for Trump's economic team, which is mostly composed of businessmen with few economists.

Stagflation, a combination of slow growth and persistently high price pressures, is also a concern. According to Wei Shangjin, former chief economist of the Asian Development Bank, there are many similarities to the stagflation caused by the oil shock in the 1970s. However, the big difference is that it was unavoidable then, but now it is caused by unnecessary and avoidable policies.

In all scenarios, the impact on the U.S.'s trading partners will be severe. China, the EU, and India's exports to the U.S. are expected to be most affected. However, their large domestic markets are expected to withstand the impact, while Canada and Southeast Asian countries with smaller domestic markets are expected to be hit hardest.

Trump has stated that reciprocal tariffs will be implemented in response to tariffs and non-tariff barriers imposed by trading partners on U.S. goods. Trump's economic team has been working for a month, including specific taxes and charges from trading partners, such as trade surpluses with the U.S. and value-added taxes.

Bloomberg Economics quantified four factors of trade dissatisfaction from the Trump administration for the top 15 countries with the largest U.S. trade deficits last year to calculate country-specific scores. This is based on the assumption that these trade dissatisfaction factors will form the basis for calculating reciprocal tariffs.

These include △ last year's U.S. trade deficit by country △ tariff differences with the U.S. △ value-added tax of trade partners △ other non-tariff barriers.

The evaluation showed that Korea had the lowest dissatisfaction score of 16% among the 15 countries. Although it ranks 8th in terms of the U.S. deficit size, it was found to have fewer tariff differences, value-added tax levels, and other non-tariff barriers compared to other surplus countries.

The country with the highest dissatisfaction score was Italy, which ranked 11th in the U.S. trade surplus but was rated high for its value-added tax rate and non-tariff barriers, scoring 60%. Ireland, also high in value-added tax and non-tariff barriers, ranked second with 58%, and China, ranking first in trade surplus and non-tariff barriers, ranked third with 54%.

Taiwan, with a larger trade surplus than Korea and slightly higher tariff differences, had a dissatisfaction score of 28%.

Japan, with a slightly larger trade surplus and higher non-tariff barriers than Korea, was calculated to have a dissatisfaction score of 21%.

Mexico, which ranks second in the U.S. trade surplus after China but has no tariff differences and the least non-tariff barriers similar to Korea, was evaluated at 20%, while Canada was rated with a dissatisfaction score of 38% due to high non-tariff barriers.

However, much of the final tariff plan remains shrouded in mystery, and it is uncertain whether these quantitative evaluation results will align with Trump's reciprocal tariff plan. The final tariff rates by country or the ripple effects and reactions from businesses and consumers may not be known even at the White House Rose Garden at 5 a.m. Korean time.

Among trade partners, China retaliated with counter-tariffs earlier this year, but to a lesser extent than the U.S. The EU and Canada immediately retaliated against steel and aluminum tariffs. However, several countries, including India and Vietnam, have pledged to purchase more U.S. goods and promised tariff reductions.

Guest Reporter Kim Jung-ah kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.