Summary

- As the altcoin market enters a slump, an analysis suggests that it is time to consider a Dollar Cost Averaging strategy.

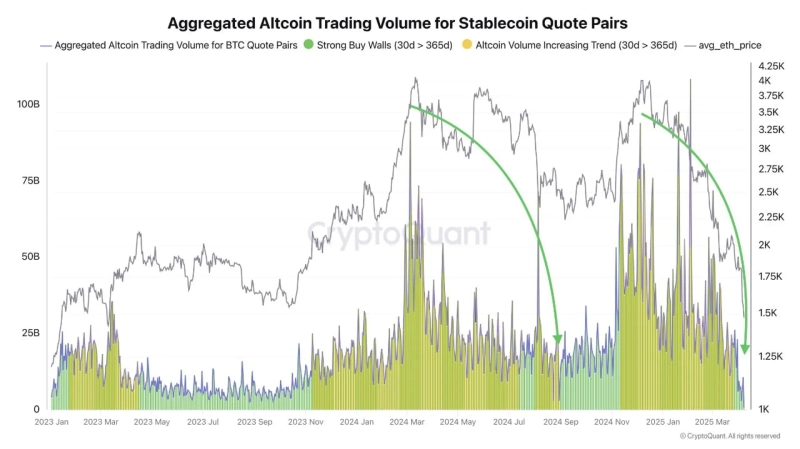

- According to CryptoQuant's analysis, the 30-day average trading volume of altcoin-stablecoin pairs has entered a zone below the 365-day average.

- Darkfost emphasized that the DCA strategy has performed well during past low-volume periods, indicating that such times are favorable for buyers.

As the altcoin market enters a slump, an analysis suggests that it is time to consider a Dollar Cost Averaging (DCA) strategy from a mid-term perspective.

On the 11th (local time), CryptoQuant author Darkfost stated, "The 30-day average trading volume of altcoin-stablecoin pairs has entered the 'green zone', falling below the 365-day average. This indicates low trading volume and a sluggish market overall. Such signals generally represent a favorable timing for buyers," he analyzed.

The author continued, "The current level was last seen in September 2023. Although this phase may last for weeks or months, the DCA strategy has performed well in past low-volume situations," he reported.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)