Xi Jinping publicly criticizes Trump... Still many 'retaliation cards' hidden [Click China]

Summary

- China has announced that it is implementing retaliatory measures against the U.S.'s high tariffs by imposing identical high tariffs and enforcing non-tariff retaliations such as restricting rare earth exports.

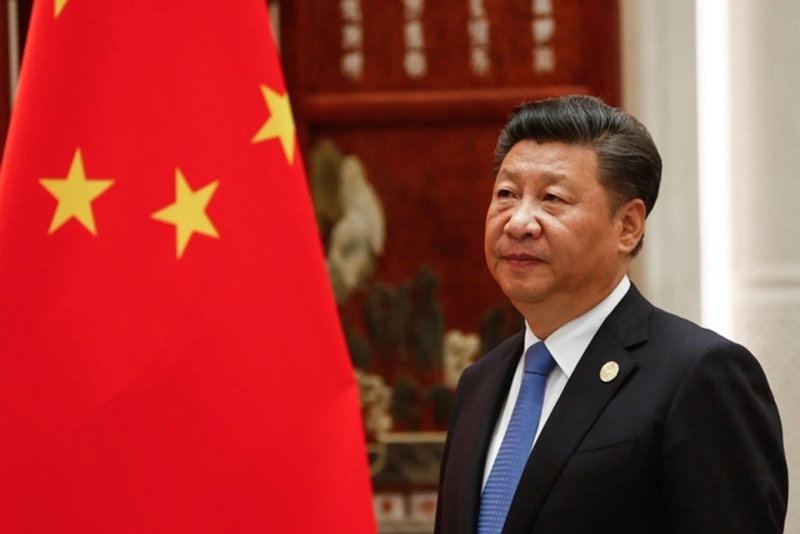

- President Xi Jinping has directly criticized the U.S. president regarding the tariff war, pointing out the problems of protectionism.

- China still holds additional 'retaliation cards,' which could include restricting imports of U.S. agricultural products or devaluing the yuan.

China is maintaining a firm and strong stance against the U.S., which has ignited the tariff war. While imposing retaliatory tariffs in a tit-for-tat manner, it is also focusing on non-tariff retaliations such as reducing imports of American films and controlling rare earth exports.

Messages directed at the U.S. are becoming more aggressive. In the early stages of the tariff war, public criticism was restrained, but now Chinese President Xi Jinping is directly raising his voice against U.S. President Donald Trump, stating that "there is no exit in protectionism."

According to Chinese media on the 14th, when the U.S. imposed a total of 20% tariffs on China in two rounds earlier this year, China showed restraint in escalating to a full-scale war. However, when the Trump administration added a 34% high tariff on China earlier this month, China immediately imposed an identical 34% tariff. With these retaliatory tariffs continuing, China's tariff rate on the U.S. has reached a total of 125% since the 12th.

China is also intensifying non-tariff retaliatory measures. According to the New York Times (NYT), China has stopped exporting rare earths and magnets essential for manufacturing advanced products such as automobiles, aerospace, semiconductors, and military weapons since the 4th. The controlled items include heavy rare earths and rare earth magnets such as gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium.

Heavy rare earths are also used in chemicals for manufacturing laser equipment, car headlights, and spark plugs. They are also key materials for AI servers and smartphone chips. Given China's monopolistic position as a rare earth supplier in the global market, it is interpreted as an attempt to inflict substantial damage on the U.S. industry. China produces 99% of the world's heavy rare earth supply as of 2023.

If the supply of rare earths and magnets is delayed, production lines at electric vehicle factories in Detroit, USA, may come to a halt. Although U.S. companies have stockpiled rare earths in preparation for emergencies, the amount varies by company, making it difficult to accurately predict the timing of production disruptions. In addition, China is quickly taking non-tariff measures such as advising against travel and study in the U.S. and reducing imports of American films.

Xi Jinping publicly criticizes the U.S.

President Xi, who has so far been reluctant to make public statements, is now openly targeting President Trump. During his tour of three Southeast Asian countries, President Xi criticized the U.S. engaging in a tariff war through an article in a Vietnamese media outlet.

In an article in the People's Daily, the organ of the Communist Party of Vietnam, President Xi targeted President Trump, saying, "There are no winners in trade wars and tariff wars, and there is no exit in protectionism." He also emphasized, "We must firmly maintain the multilateral trading system, ensure the stability of the global industrial and supply chains, and maintain an open and cooperative international environment."

Along with this, President Xi explained, "Amid the rise of unilateralism and protectionism, the Chinese economy achieved 5% growth last year and maintained a contribution rate of about 30% to global economic growth, continuing to be an important engine of the world economy." President Xi will make a state visit to Vietnam, Malaysia, and Cambodia from today until the 18th amid the escalating tariff war with the U.S.

Surge in Chinese exports due to stockpiling demand

In this situation, China's export performance last month exceeded market expectations. This is because major trading partners showed a tendency to pre-purchase Chinese products ahead of tariff imposition.

According to the General Administration of Customs of China, China's exports last month increased by 12.4% compared to the same period last year, far exceeding the market forecast of 4.4%. This is higher than the growth rate of 1-2 months this year (combined announcement due to the Lunar New Year holiday, 2.3%).

Despite the intensifying tariff war, China's exports have rebounded. The announcement of a significant increase in U.S. tariffs on China had a substantial impact on increasing export volumes in advance. In fact, compared to March last year, China's exports to the U.S. in March this year increased by 9.1%, far exceeding the 2.3% of January-February this year. During the same period, China's imports decreased by 4.3%, less than the decline of 8.4% in January-February. Thanks to strong exports, the trade balance recorded a surplus of $12.64 billion. The market forecast was $7.7 billion.

The General Administration of Customs explained, "The excessive imposition of tariffs by the U.S. is negatively affecting global trade," and "For several years, China has developed various markets, deepened supply chain cooperation with countries, and strengthened resilience."

However, there are also forecasts that China's exports could be significantly reduced from April this year, when the impact of U.S. tariffs begins in earnest. Bloomberg News predicted, "As neither the U.S. nor China shows signs of lowering tariffs or making concessions, the ripple effects of the tariff war will be felt from this month."

Additional cards China has hidden

Experts believe that China still has many retaliation cards that have not been revealed. First, the level of export restrictions on rare earths or critical minerals can be raised. In addition, restricting imports of U.S. agricultural products could be another retaliation card for China.

Already, immediately after President Trump's 20% additional tariff last month, China imposed retaliatory tariffs of 10-15% on U.S. chicken, wheat, corn, cotton, sorghum, soybeans, and pork. This implies the possibility of expansion. Retaliation against U.S. agricultural products could directly impact the farming community, a major support base for the Republican Party, and become a 'pain point' for President Trump.

The devaluation of the Chinese yuan is also considered another retaliation card. If the yuan's value falls, China's export competitiveness increases, offsetting the impact of the U.S.'s high tariffs. Additionally, the sale of U.S. Treasury bonds held by China is being pointed out as a powerful retaliation tool. If China sells a large amount of U.S. Treasury bonds, it could cause interest rates to soar, shocking the U.S. economy.

In this situation, China is seeking solidarity with U.S. allies, including Southeast Asia. Mary Lovely, a senior fellow at the Peterson Institute for International Economics in the U.S., said in an interview with the BBC, "What we are seeing is a game of who can endure more pain," and "Despite the slowdown in economic growth, China is willing to endure pain to avoid succumbing to U.S. aggression."

Beijing=Kim Eun-jung, Correspondent kej@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Today’s key economic and crypto calendar] Remarks by Fed Governor Christopher Waller, among others](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] AI tech shares draw bargain hunting, lifting markets together… Dow sets another record high](https://media.bloomingbit.io/PROD/news/c018a2f0-2ff5-4aa8-90d9-b88b287fd926.webp?w=250)