Summary

- Bitcoin is showing signs of easing overheating, and it is likely to turn to an upward trend in 2025.

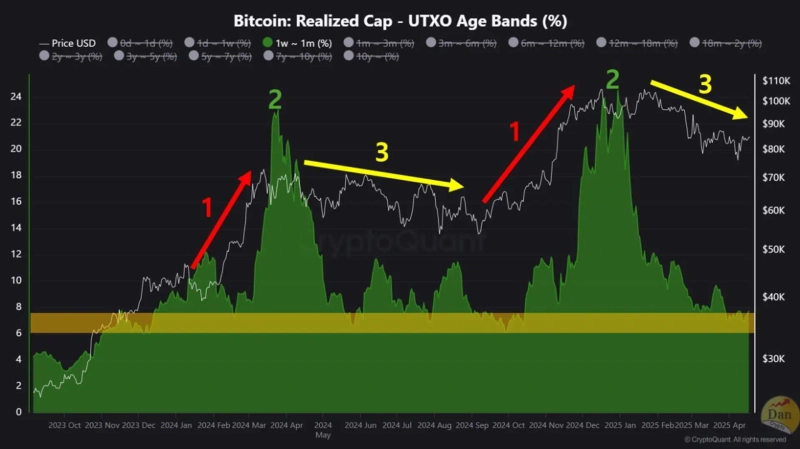

- The 'ratio of Bitcoin held for less than 1 week to 1 month', an indicator of market overheating, has fallen to the bottom level of the 2024 adjustment phase.

- In the short term, additional observation may continue, but with progress in macroeconomic issues, there is a possibility of an upward trend.

Bitcoin (BTC) is showing signs of easing overheating, raising expectations for a rebound this year.

On the 18th (local time), CryptoQuant author CryptoDan explained, "The ratio of Bitcoin (BTC) held for less than 1 week to 1 month is typically a key indicator to gauge market overheating. When this ratio increases along with price rises, corrections or declines often occur afterward. In this cycle, such movements occurred twice on a small scale, and the intensity of overheating appeared at similar levels."

The author continued, "Currently, this ratio has fallen to the range (yellow box) identified as the bottom of the 2024 adjustment phase, suggesting that a similar market environment is being formed. In other words, most of the market overheating has been resolved," and predicted, "In the short term, additional observation may continue, but with macroeconomic issues progressing, the Bitcoin market is likely to turn back to an upward trend in 2025."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)