Summary

- Citibank reported that it raised its gold price forecast from $3,200 to $3,500 per ounce due to increased gold purchases by central banks in emerging markets.

- Bitcoin has shown little recent price movement and remains stuck in the $80,000 range, with investment banks noting the potential decoupling of gold and Bitcoin.

- Bitcoin, known as 'digital gold', is used as a hedge against currency value decline and may follow gold's price direction with a 100-150 day lag, according to experts.

Citi Raises Gold Price Forecast by $300

"Increasing Gold Purchases in Emerging Markets"

'Digital Gold' Bitcoin Continues Sideways Trend

JP Morgan "Gold and Bitcoin, Opposite Trends"

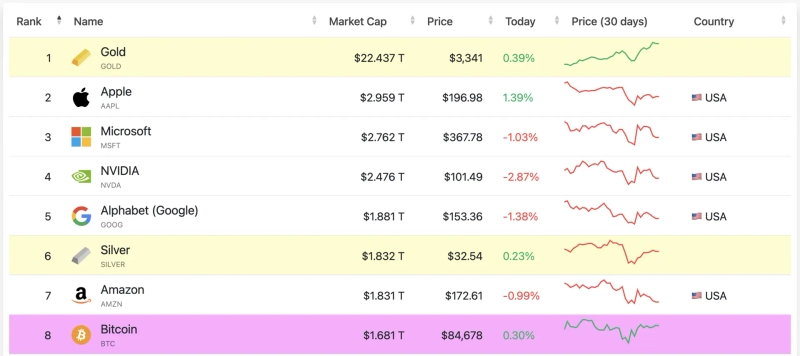

Gold prices are soaring daily due to the impact of the U.S.-initiated tariff war. Meanwhile, Bitcoin (BTC), which has been noted as an alternative asset alongside gold, is stuck in the mid-$80,000 range. Market analyses are divided over the correlation between gold and Bitcoin.

On the 17th (local time), according to Reuters and others, global investment bank (IB) Citibank raised its gold price forecast for the next three months from $3,200 per ounce to $3,500, an increase of $300. Citibank stated, "Central banks in emerging markets, including China, are increasing their gold purchases," and "Gold investment and industrial demand in the second quarter of this year will increase to 110% of mine supply." Reuters reported that the gold demand forecast for the second quarter is "the highest level since the global financial crisis."

Gold Surpasses 'M7' Amid Continuous Rally

The gold price rally began in earnest in the first quarter. It coincides with the time when U.S. President Donald Trump began to implement tariff policies. With increasing economic uncertainty due to global trade conflicts and a weakening dollar, the demand for safe assets surged. As a result, gold prices surpassed $3,000 per ounce for the first time last month and broke the $3,350 mark during trading on the 17th, setting a new all-time high.

As gold prices soared, funds also flowed into related investment products. According to the World Gold Council (WGC), global gold exchange-traded funds (ETFs) saw a net inflow of $21.1 billion (about 30 trillion won) in the first quarter alone. This is the largest net inflow since the first quarter of 2022, when economic uncertainty increased due to Russia's invasion of Ukraine.

Regarding this, global investment bank JP Morgan analyzed, "Investors seeking safe assets are driving fund inflows into gold in the futures and ETF markets." U.S. investment bank Bank of America (BoA) stated, "(Recently) gold futures trading volume has surpassed the 'Magnificent 7 (M7, the top 7 U.S. tech stocks)' and has become the busiest trade on Wall Street."

"Bitcoin, 100-150 Day Lag Behind Gold"

However, Bitcoin, which is considered an alternative investment like gold, continues to show a sideways trend. According to the cryptocurrency market tracking site CoinMarketCap, Bitcoin prices have not escaped the mid-$80,000 range this month. After price adjustments from February to last month, it settled in the mid-$80,000 range but has struggled to break through the short-term resistance level of $85,000.

Given the situation, there is a view that gold and Bitcoin have decoupled. Initially, Bitcoin was called 'digital gold' and showed a high correlation with gold. However, Bitcoin began to show coupling with the U.S. stock market as it started to be incorporated into institutional finance, marked by the launch of a spot ETF last year. JP Morgan stated, "Gold and Bitcoin are showing opposite trends," and "Bitcoin is not benefiting from the demand for safe assets."

There is also speculation that Bitcoin will follow the gold price uptrend. As Bitcoin is being used as a hedge against inflation and the decline in fiat currency value, demand is expected to continue to increase. Joe Consorti, Chief Growth Officer at Bitcoin custody firm Theya, stated, "(Typically) Bitcoin prices follow the direction of gold prices with a lag of 100-150 days." On-chain analysis firm Glassnode analyzed, "The decline in Bitcoin is similar to the typical correction phase during previous bull markets," and "Despite macroeconomic uncertainties, gold and Bitcoin are showing notably resilient trends."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Market] Bitcoin steadies after 'wash shock'…reclaims the $79,000 level](https://media.bloomingbit.io/PROD/news/2d67445a-aa24-46b9-a72d-5d98b73b6aec.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] Atlanta Fed GDPNow, More](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)