Summary

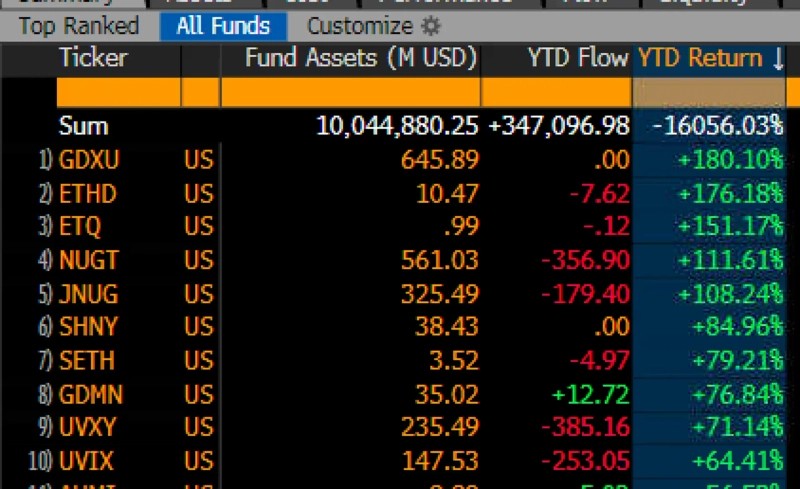

- The Ethereum 2x Short ETF has ranked 2nd and 3rd in US ETF returns this year.

- ETHD and ETQ have gained attention by recording increases of 176.18% and 151.17%, respectively.

- The long-term decline outlook for Ethereum and the foundation's response will be important considerations for investors.

The Ethereum (ETH) 2x leverage short (sell) exchange-traded fund (ETF) has been ranked 2nd and 3rd in the US ETF returns this year.

On the 21st (local time), Eric Balchunas, a Bloomberg ETF analyst, stated on X, "The Ethereum 2x Short ETF is one of the highest-yielding ETFs this year," adding, "ETHD and ETQ recorded returns of 176.18% and 151.17%, respectively, ranking 2nd and 3rd in this year's returns." ETHD and ETQ are Ethereum 2x leverage short ETFs launched by ProShares and Rex Shares. The 1st place was taken by MicroSectors' 3x leverage gold miners ETF (180.10%).

Recently, Ethereum has been on a continuous decline, with negative outlooks prevailing. Previously, Binance Research reported, "Ethereum Layer 2 blockchains are threatening Ethereum's position. It could negatively impact Ethereum's price." Last month, global investment bank Standard Chartered also reported, "Due to Layer 2 blockchain issues, Ethereum's decline will continue," and "We are lowering this year's price forecast from $10,000 to $4,000."

However, the fact that the Ethereum Foundation is aware of these issues could be a catalyst for a rebound. Today, Tomasz Stanczak, co-director of the Ethereum Foundation, said, "Vitalik Buterin, Ethereum co-founder, will spend more time on research and exploration rather than routine coordination or crisis response. We plan to create a long-term breakthrough for Ethereum."

As of 9:41 PM, Ethereum is trading at $1,627, up 3.17% from 24 hours ago, based on Binance USDT market.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit