Editor's PiCK

‘Clarity Act stalled’ adds another headwind… Bitcoin rebound timing ‘still unclear’

Summary

- It said that uncertainty over U.S. digital-asset regulation, especially the stalling of the Clarity Act, is acting as a headwind behind Bitcoin’s (BTC) downtrend.

- It noted that if passage of the Clarity Act becomes more difficult due to disagreements between banks and the industry over stablecoin yield, legislative momentum could weaken and regulatory uncertainty could persist.

- It reported that the report and industry participants expect that if the Clarity Act passes within the year, it could reduce long-term uncertainty, drive a strong rebound in the Bitcoin market, and open the door to a broader market-wide rally in digital assets.

Uncertainty over U.S. digital-asset regulation comes into focus

‘Clarity Act’ faces hurdles…a negative for the market

Divisions over ‘stablecoin yield’

“Bitcoin could rebound if the bill passes”

As Bitcoin (BTC) remains unable to shake its downtrend, uncertainty over U.S. regulation of digital assets (cryptocurrencies) is coming into focus and weighing on the market. The “Digital Asset Market Structure Bill (Clarity Act),” long viewed as a medium- to long-term positive catalyst, is struggling to clear the legislative process.

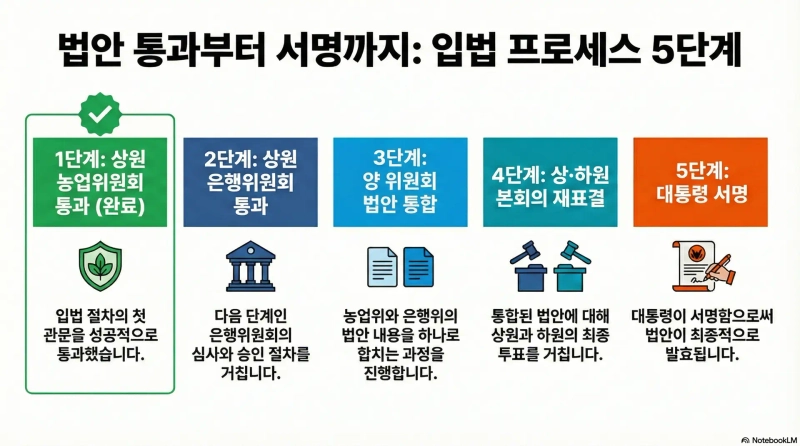

After the U.S. Senate Committee on Agriculture, Nutrition, and Forestry passed the “Digital Commodity Intermediaries Act,” based on the Clarity Act, on the 29th of last month (local time), banking-sector and digital-asset industry participants failed to narrow their differences over the “stablecoin yield” issue at a meeting convened by the White House on the 2nd.

“Stablecoin yield” is seen as one of the Clarity Act’s key sticking points. Banks argue that if digital-asset platforms are allowed to pay yields without clear limits, bank deposits could flow out and undermine the stability of the financial system. The industry, by contrast, counters that an outright ban on yields could weaken the competitiveness of the U.S. stablecoin sector and dilute the legislation’s aim of protecting users. Both sides must present a compromise proposal to the White House by the end of this month.

According to blockchain outlet The Block Crypto on the 2nd, investment bank TD Cowen said it would be difficult for the Clarity Act to pass unless U.S. President Donald Trump forces a compromise between banks and the industry. The need to secure Democratic support is also cited as a major hurdle.

Wall Street investment bank Bernstein said the Clarity Act must pass in the second quarter of this year, before the U.S. enters the midterm election phase, adding that a prolonged dispute over stablecoin yields would sap momentum for the legislation. After August, when the country shifts into full election mode, there will be little bandwidth to process complex bills.

There are also optimistic forecasts that the Clarity Act will pass within the year. Digital-asset manager CoinShares said in a recent report that while crypto-related bills have repeatedly faced obstacles in the past, the stablecoin-related “GENIUS Act” ultimately passed last summer, adding that if the industry and the government reach an agreement, the Clarity Act could clear key hurdles and pass within the year.

The report said the Clarity Act would significantly reduce long-term uncertainty for both the industry and regulators, and bolster investor confidence in the U.S. oversight framework, adding that it could open a clear path for compliant initial public offerings (IPOs).

Analysts also say passage of the Clarity Act could trigger a strong rebound in the Bitcoin market. Matt Hougan, chief investment officer (CIO) at Bitwise, said that if the Clarity Act passes, growth pathways related to stablecoins and real-world asset (RWA) tokenization would become clearer, increasing the likelihood of a sizable rally across the broader digital-asset market.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.