Summary

- Cas Abbe stated that the Bitcoin price would start a significant rally with $74,000 to $75,000 as the bottom.

- The accumulation movements of whale investors and the rise in the Coinbase premium were presented as major signals for Bitcoin's rebound.

- It was reported that the record-breaking gold price and increase in global liquidity would positively impact Bitcoin's price rise.

An analysis has emerged suggesting that Bitcoin (BTC) is poised for a significant rise after hitting a bottom.

On the 21st (local time), virtual asset (cryptocurrency) analyst Cas Abbe stated on X, "Bitcoin's bottom was in the range of $74,000 to $75,000. Most altcoins have also hit their bottoms," adding, "A sustained rally of Bitcoin is expected to continue."

The main reasons for Bitcoin's rebound include the accumulation movements of whale investors and the rise in the Coinbase premium. Cas Abbe analyzed, "At the end of last year, large investors (whales) aggressively sold Bitcoin, but in the past six weeks, they have repurchased about 100,000 BTC (approximately $8.75 billion)," suggesting that this is a signal indicating the potential for market rise. He further added, "The Coinbase premium has also turned positive in recent days," noting, "This premium is an important indicator for identifying institutional investors' accumulation, and there have been instances in the past where the market surged after turning positive."

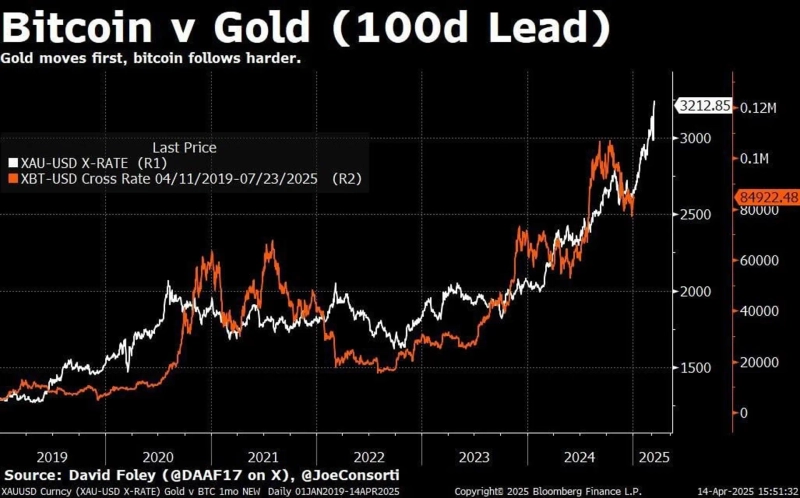

Additionally, the record-breaking gold price and the increase in global liquidity are also analyzed to be favorable for Bitcoin. On this day, the spot price of gold surpassed $3,500 per ounce, marking an all-time high. Cas Abbe explained, "Historically, after gold hits a new peak, Bitcoin tends to follow with a rise."

Along with this, the global M2 (a liquidity indicator including cash, demand deposits, and time deposits under two years) reached a record high of $108.5 trillion. This can increase liquidity in the market and positively impact Bitcoin's price rise.

Cas Abbe predicted, "There won't be a sharp rise until the Federal Reserve (FED) fully enters a quantitative easing (QE) mode, but the current range is likely to be the starting point for a long-term rally."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit