Editor's PiCK

US-Taiwan Trade Negotiations 'Butterfly Effect'... Won-Dollar Exchange Rate Plummets to 1300 Won

Summary

- It was reported that the possibility of the Taiwanese government allowing its currency to appreciate in trade negotiations with the US has led to the simultaneous strengthening of the Taiwanese dollar and Korean won in the Asian forex market.

- It was reported that Taiwanese life insurers have strengthened their currency hedging by choosing alternative currencies like the Korean won due to the surge in the Taiwanese dollar, leading to an increase in the value of the won.

- Some experts interpreted these changes as a major sign that the dollar hegemony might be shaking.

Is the US Pressuring on Exchange Rates... Turbulent Asian Forex Market

Rumors of Taiwan Government Allowing Currency Appreciation

Taiwanese Currency Value Rises Most in 30 Years

Life Insurers' Currency Hedging Fuels Appreciation

Sparks Fly to Won, Surging Along

Authorities' Intervention Temporarily Calms Forex Market

South Korea Faces Dilemma Ahead of Trade Talks with US

Increased Exchange Rate Volatility Spurs Search for Countermeasures

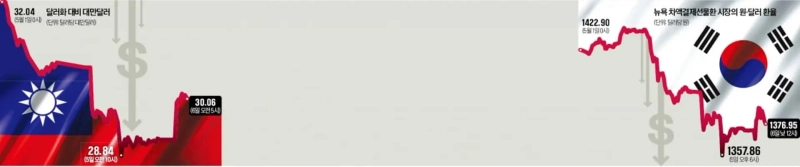

The simultaneous strengthening of Asian currencies since last weekend is analyzed as a result of the widespread observation that the Taiwanese government allowed its currency to appreciate in tariff negotiations with the US. During the period when the forex market was halted for a four-day holiday, an unusual situation occurred where the won-dollar exchange rate plummeted to the 1300 won range (Korean won appreciation) in the offshore non-deliverable forward (NDF) market. The market interprets the movement of the less-traded Taiwanese currency causing Asian currencies to fluctuate as a sign of the weakening status of dollar hegemony. The forex authorities, who are about to negotiate exchange rates with the Trump administration, are keenly watching the won-dollar exchange rate trend.

◇NVIDIA Export Regulation Easing as a Trigger

The simultaneous appreciation of Asian currencies began on the 1st (local time) with a media report that "the Donald Trump administration is considering easing restrictions on NVIDIA semiconductor exports to the United Arab Emirates (UAE)." The expectation that Taiwanese semiconductor manufacturers like TSMC would increase exports and show economic improvement if semiconductor export restrictions were lifted led to the Taiwanese dollar strengthening.

After the first trade negotiations between the US and Taiwan on the 3rd, the Taiwanese forex authorities did not respond to the strengthening of the Taiwanese dollar, leading to rumors in the market that "Taiwan will propose currency appreciation as a means of trade negotiation with the US."

The Taiwanese life insurers fueled the appreciation of the Taiwanese dollar. Taiwanese life insurers invest the insurance premiums (liabilities) received in Taiwanese dollars in US Treasury bonds. Until now, they have hedged currency risks by selling US forward contracts (buying Taiwanese dollars and selling US dollars), but recently, it is estimated that they have reduced the hedging ratio to 40%. This was because they expected the Taiwanese central bank would not allow the appreciation of the Taiwanese dollar.

Contrary to expectations, as the value of the Taiwanese dollar surged, life insurers belatedly engaged in currency hedging by selling US dollars and buying Taiwanese dollars (selling US forward contracts), causing the Taiwanese dollar-US dollar exchange rate to plummet (Taiwanese dollar appreciation). On May 5, 2025, the value of the Taiwanese dollar rose by 5%. It was the largest increase in a single trading day in 30 years. The appreciation over the two trading days on the 2nd and 5th exceeded 9%.

◇Taiwanese Life Insurers' Currency Hedging Causes Won to Surge

The impact of the Taiwanese dollar appreciation on the Korean market was due to the influence of the NDF market. Taiwan has a small forex market and prohibits domestic companies and financial institutions from trading the Taiwanese dollar in the NDF market. The currency that Taiwanese life insurers turned to for currency hedging, unable to hedge as desired, was the proxy currency, the Korean won. A proxy currency is a currency used indirectly like the currency of a country with close economic and financial market relations. Due to its high export dependency and similar export-oriented industries like semiconductors and electronic components, the Korean and Taiwanese currencies are used as proxy currencies.

As Taiwanese life insurers secured dollar forwards in the NDF market to hedge currency risks, the value of the Korean won surged. Along with the won, the value of the yuan, also used as a proxy currency for the Taiwanese dollar, surged during the same period. This is the reason for the simultaneous appreciation of Asian currencies.

The Taiwanese dollar exchange rate, which had fallen to 29.18 Taiwanese dollars per dollar the previous day, rebounded to 30.18 Taiwanese dollars per dollar on this day. This was due to the Taiwanese forex authorities strongly denying rumors by stating, "We intervened in the forex market to prevent the appreciation of the Taiwanese dollar." The won-dollar exchange rate, which had fallen below 1360 yen in the NDF market the previous day, also rebounded to 1386.95 dollars in the afternoon.

◇Interpretation of "Dollar Hegemony Shaking"

As the values of the Taiwanese dollar and the won, which had surged together, turned to simultaneous declines, the forex market expects the simultaneous appreciation of Asian currencies to somewhat calm down. A forex market expert said, "The won-dollar exchange rate will start trading around 1390 won on the morning of the 7th." Forex market experts are leaving open the possibility that the exchange rate will settle in the 1300 won range for the time being.

There is also an interpretation that this situation shows a facet of the shaking dollar hegemony. Former Vice Minister of Strategy and Finance Kim Yong-beom analyzed on his SNS, "Trust in the US dollar is shaking, and the focus on domestic currencies in current account surplus countries like Taiwan is strengthening," and "This surge may not be a temporary happening but a more medium-term signal."

The forex derivatives market, where only the exchange rate difference at maturity is settled without exchanging foreign currencies. The Korean forex market trades from 9 a.m. to 2 a.m. the next day, but the NDF trades 24 hours, revolving around the Hong Kong, Singapore, London, and New York markets. The won exchange rate in the New York NDF market is reflected in the opening price of the won-dollar exchange rate in the Korean market on the same day.

Jung Young-hyo/Nam Jung-min, Reporters hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "Bitcoin attempts a technical rebound after capitulation selling…trend reversal hinges on fresh inflows"](https://media.bloomingbit.io/PROD/news/067f7da2-2764-45b9-a79c-b8a9c31d4919.webp?w=250)