Summary

- Coinbase announced a plan to acquire Deribit for $2.9 billion, but reported first-quarter revenue below expectations.

- Wall Street analysts, including JP Morgan, have lowered Coinbase's revenue forecasts due to declining fees and reduced institutional investment.

- Bernstein positively assessed that the Deribit acquisition will strengthen Coinbase's position in the global market and increase the likelihood of regulatory approval.

Global cryptocurrency exchange Coinbase has announced a $2.9 billion acquisition plan for Deribit and reported first-quarter revenue that fell short of market expectations, leading to mixed analyst opinions about the exchange.

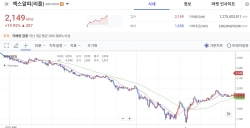

According to cryptocurrency media outlet CoinDesk on the 9th (local time), Coinbase's first-quarter revenue was $2.03 billion, 12% below the market expectation of $2.1 billion.

Trading revenue decreased by 19% to $1.3 billion. Consequently, Wall Street analysts, including JP Morgan, have lowered their second-quarter and annual revenue forecasts, citing declining fees and reduced institutional investment. Nevertheless, Bernstein positively projected that "the Deribit acquisition will strengthen Coinbase's position in the global market and ultimately enable it to receive cryptocurrency options approval from U.S. regulators."

Amid declining trading revenue, there is also an assessment that growth drivers such as stablecoin revenue growth and infrastructure services like custody and trading technology will become key pillars of revenue, serving as a hedge against volatile market activities.

JH Kim

reporter1@bloomingbit.ioHi, I'm a Bloomingbit reporter, bringing you the latest cryptocurrency news.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)