Summary

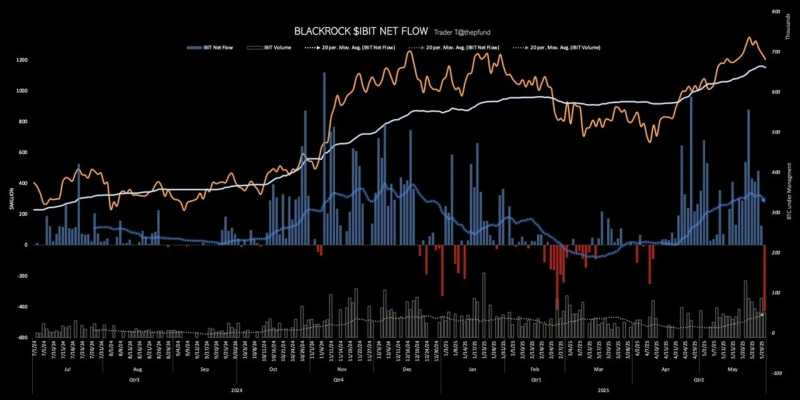

- BlackRock’s Bitcoin spot ETF (IBIT) recorded the largest net outflow of approximately $428.62 million.

- This massive capital outflow was attributed to the recent decline in Bitcoin prices.

- The market believes that trade tensions between the United States and China have increased sell pressure on risk assets.

BlackRock, the world’s largest asset manager, saw its Bitcoin (BTC) spot ETF ‘IBIT’ experience the largest net outflow since its launch.

According to TraderT on the 30th (local time), a total of 4,113 Bitcoins were withdrawn from IBIT on this day. In terms of value, that amounts to approximately $428.62 million (about ₩586 billion), marking the largest daily outflow since IBIT’s inception in USD terms.

This large-scale capital exodus coincided with the recent downward trend in the price of Bitcoin. Over the past five days, Bitcoin has declined by about 6%, falling to the $103,400 level in the Binance USDT market on this day. This is the lowest point in about 12 days.

The market believes that remarks by Donald Trump, President of the United States, have affected investor sentiment. President Trump, via his Truth Social account, indicated the possibility of reimposing high tariffs by stating, “China has completely violated our agreement.” Renewed concerns over escalating trade tensions between the United States and China are seen as increasing the selling pressure on risk assets.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)