'Strategic Ethereum Accumulation' by Sharplink: Company Stock Soars 2000% Last Week…Down 30% Today

Summary

- Sharplink Gaming revealed its strategic move to include Ethereum as a financial asset.

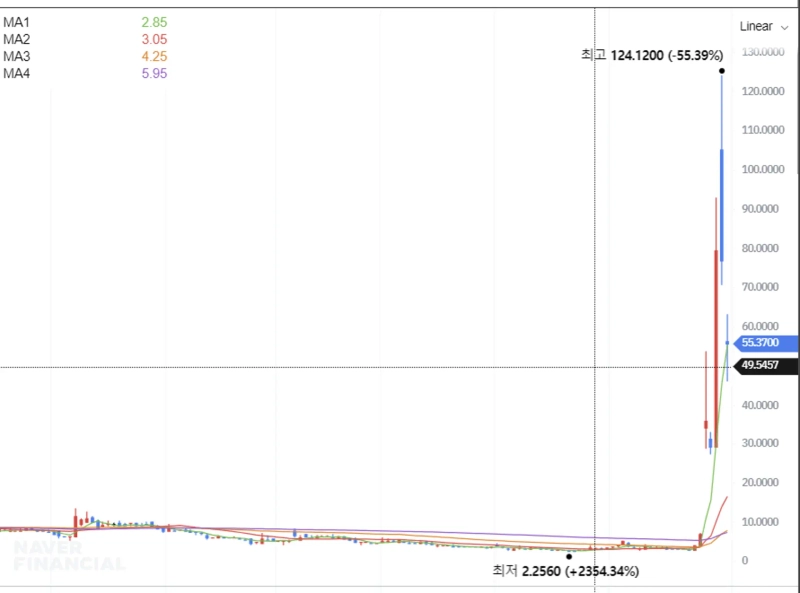

- As a result, Sharplink Gaming's stock price soared by about 2000% last week, but recently dropped by 27.81%.

- The company successfully raised $425 million and plans to bring in CEO Joseph Lubin to its board.

Sharplink Gaming, which attracted market attention by including Ethereum (ETH) as a financial asset, saw its stock slump during trading. Previously, Sharplink Gaming had recorded a 2000% surge in share price last week.

According to crypto-specialized media outlet CoinDesk on the 2nd (local time), Sharplink Gaming closed at $55.37 for the day—down 27.81% during trading. In OTC trading, the price fell an additional 5.08% and is now at $52.56.

On the 27th, Sharplink Gaming announced it would sell 69 million shares to accumulate Ethereum and aimed to raise $450 million. The fundraising completed on that day, with Sharplink Gaming succeeding in securing a total of $425 million.

This announcement by Sharplink Gaming had a significant effect on its stock price. The stock, which was previously trading under $3, soared around 2000% after the announcement, reaching up to $124.12.

Meanwhile, Sharplink Gaming plans to appoint Joseph Lubin, CEO of ConsenSys (an Ethereum infrastructure company), to its board to execute this strategy.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.