Australia strengthens regulation of virtual asset ATMs, referred to as a ‘hotbed of crime’…"Fraud prevention"

Summary

- Australia announced plans to tighten regulations in response to the recent rise in fraud crimes related to virtual asset ATMs.

- It was reported that the ATM withdrawal limit was set to 5,000 Australian dollars, and registration of new virtual asset ATM companies was denied.

- It was stated that people in their 50s and above account for 72% of virtual asset ATM users in Australia.

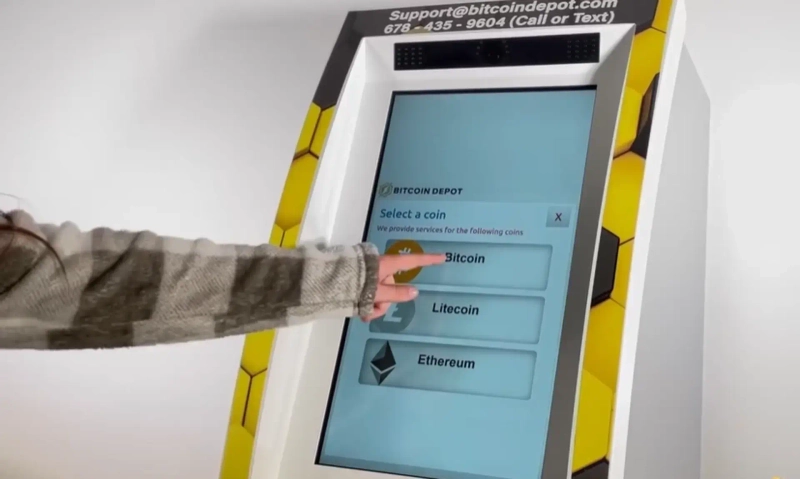

Australia plans to tighten regulations regarding virtual asset (cryptocurrency) automated teller machines (ATMs). This measure comes in response to a surge in fraud crimes related to virtual asset ATMs.

According to Bloomberg News on the 3rd (KST), the Australian Transaction Reports and Analysis Centre (Austrac) has set the cash withdrawal limit for virtual asset ATMs at 5,000 Australian dollars to protect consumers.

Additionally, Austrac has recently refused registration for new virtual asset ATM companies.

Brandon Thomas, CEO of Austrac, stated in a press release, "We have confirmed that virtual asset ATMs are being used for fraud-related transactions," adding, "In response, we have introduced enhanced customer due diligence obligations and strong requirements for transaction monitoring."

According to Austrac, there are currently over 1,800 virtual asset ATMs installed in Australia. Among virtual asset ATM users, those in their 50s and above comprised 72%, with customers in their 60s and 70s making up 29%.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.