Summary

- Ethereum has drawn intensive investor attention as Sharplink Gaming’s private sale funds are being used for strategic reserves.

- USDC is seeing increased investor interest as Circle moves to list on the New York Stock Exchange, expanding its share offering and raising the price range.

- Tether attracted investor focus after moving 14,000 Bitcoin from reserves and transferring it to TwentyOne Capital.

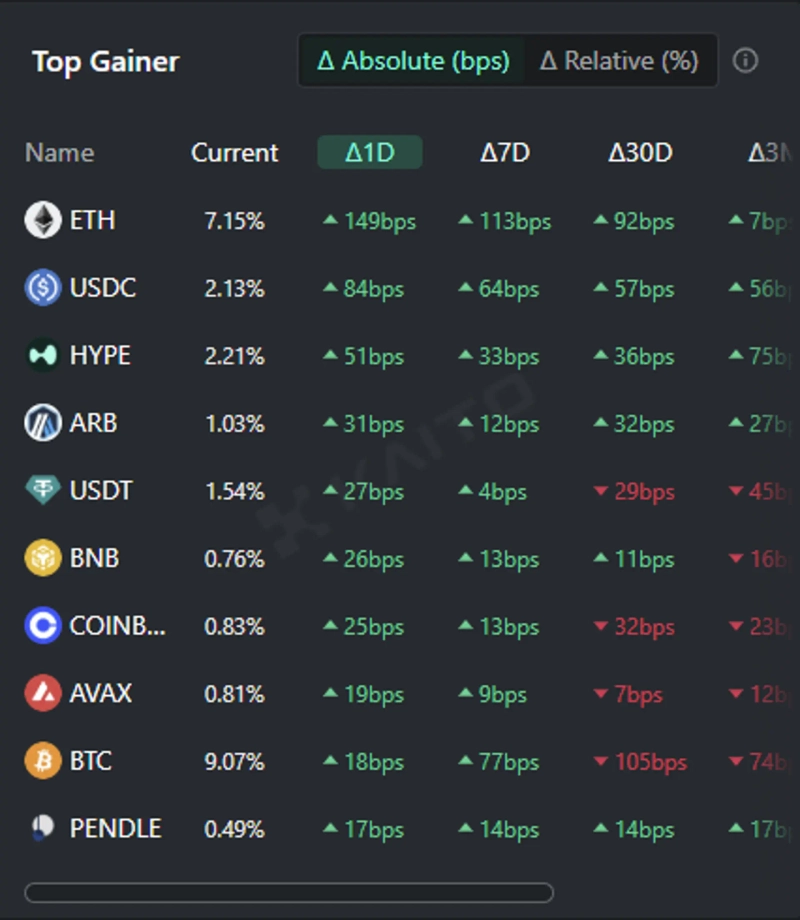

According to Kaito, an AI-based Web3 search platform, the Token Mindshare (an index that quantifies a specific token’s influence within the virtual asset market) top gainers currently on the 3rd show the five digital assets attracting the most attention today are Ethereum (ETH), USDC, Hyperliquid (HYPE), Arbitrum (ARB), and Tether (USDT).

Ethereum takes the No.1 spot. With Ethereum reserves materializing, investor interest is gathering. On this day, Sharplink Gaming announced that it had raised $425 million through a private sale. The funds will be used for Ethereum’s strategic reserve.

USDC ranked No.2. Investor interest surged as USDC issuer Circle’s IPO approaches. Circle has increased the number of offer shares for the NYSE listing from 24 million to 32 million later this week. The initial offering price has also been raised from $24–26 to $27–28 per share. The maximum estimated proceeds are calculated at ₩1,236,000,000,000.

Hyperliquid took third place. Attention arose due to a dispute between Hyperliquid whale “James Wynn” and Wintermute. James Wynn publicly disclosed his futures position the previous day and directly called out market maker “Wintermute.” Wynn claimed, "Immediately after entering a long position, some started hunting for me," and asserted, "deliberate price manipulation is occurring." Wintermute immediately responded. Wintermute said, "Wynn is amazing," and ridiculed, "He seems to be in charge of Hyperliquid’s marketing."

Arbitrum was ranked fourth.

Lastly, in fifth place was Tether. Investor focus grew after it was revealed that Tether had withdrawn 14,000 Bitcoin (BTC) from its reserves on this day. Both Tether and Bitfinex transferred 14,000 and 7,000 BTC, respectively, to their joint company, TwentyOne Capital.

Additionally, investors also showed interest in Binance Coin (BNB), Coinbase, Avalanche (AVAX), Bitcoin, and Pendle (PENDLE).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.