Editor's PiCK

Market Confidence Decreases… Bitcoin Options Open Interest on a Declining Trend

Son Min

Summary

- The scale of Bitcoin options open interest (OI) is reportedly on a declining trend.

- Glassnode reported that as open interest on both sides of positions in the options market decreases, market conviction is also weakening.

- Currently, Bitcoin is reportedly trading at $105,396, up 0.31%.

The scale of Bitcoin (BTC) options open interest (OI) is showing a declining trend.

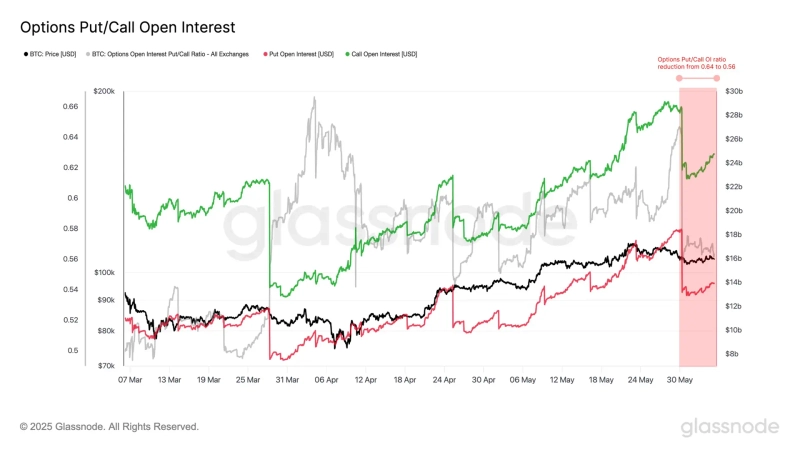

On the 4th (local time), Glassnode announced via X (formerly Twitter), "The ratio of Bitcoin options put/call open interest has fallen from 0.64 to 0.56," adding, "This is due to the decline in open interest for call options from $28.7 billion to $24.7 billion, and put options from $18.4 billion to $13.9 billion." They further explained, "Although the options market still predicts a rise, the increase in open interest on both sides of the position indicates that market confidence in direction is decreasing."

As of 6:24 PM, based on the Binance USDT market, Bitcoin is trading at $105,396, up 0.31% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)