US Ethereum Spot ETF Records Net Inflow for 14 Consecutive Trading Days... Price Remains Flat

Summary

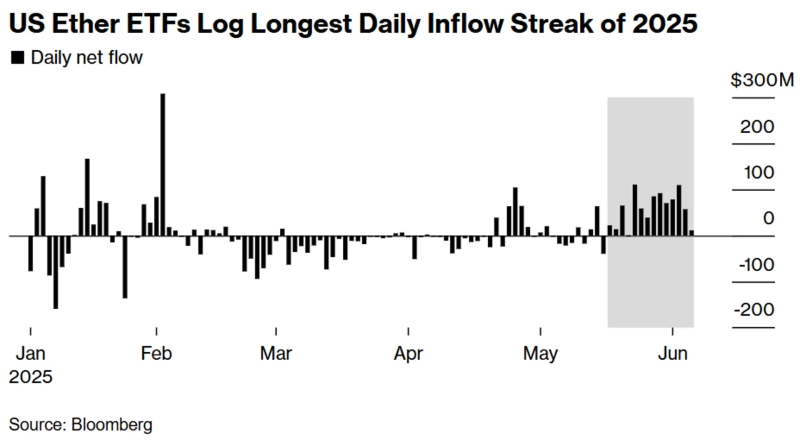

- The US Ethereum (ETH) spot ETF recorded a net inflow of $812 million over 14 consecutive trading days from May 16 to June 5.

- BlackRock's 'ETHA' accounted for 71% of total inflows, and it was reported that institutional investors' capital inflow surpassed $1 billion, drawing particular attention.

- In contrast to these capital inflows, the Ethereum price declined by about 3% over the past two weeks.

Institutional demand for Ethereum (ETH) spot exchange-traded funds (ETFs) is continuing for an extended period.

On the 6th (local time), Nate Geraci, CEO of The ETF Store, stated, “The streak of net inflows that began on May 16 continued for 14 consecutive trading days until June 5, with $812 million flowing in just during this period.”

By each ETF, BlackRock's 'ETHA' attracted $576 million, accounting for 71% of the total inflows. Fidelity's 'FETH' attracted approximately $123 million during the same period, ranking second. 21Shares' 'CETH' posted a cumulative net inflow of only $19.5 million, remaining at the lowest level.

There is also clear evidence of institutional investor capital inflow. James Seyffart, Bloomberg ETF analyst, reported on the 4th that the institutional holdings in Ethereum spot ETFs surpassed $1 billion. Citing first-quarter Form 13F filings submitted to the U.S. Securities and Exchange Commission (SEC), he explained, “Investment advisors held the largest share with about $582.4 million, followed by hedge funds with $244.7 million, and securities brokers with $159.3 million, respectively.”

In addition, various institutions, including private equity ($39.8 million), holding companies ($17.2 million), trust companies ($11.4 million), pension funds ($7 million), banks ($5.7 million), and family offices ($1.16 million), have also allocated funds into Ethereum ETFs.

However, the market price of Ethereum has stagnated. The renewed tariff conflict between the United States and China, along with escalating tensions between President Donald Trump and Elon Musk, CEO of Tesla, appear to have influenced investor sentiment. On this day, Ethereum is trading at around $2,480 in the Binance Tether (USDT) market. This is a drop of about 3% in the past two weeks.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)