US Bitcoin Spot ETF sees net outflow of $48.80 million...for 2 consecutive trading days

Doohyun Hwang

Summary

- It was reported that the US Bitcoin spot ETFs recorded a net outflow for two consecutive trading days.

- As of the 6th, it was announced that a total of $48.80 million had flowed out of Bitcoin spot ETFs.

- It was reported that the primary reason for the net outflow was the $131.45 million outflow from BlackRock's 'IBIT'.

The United States Bitcoin (BTC) spot Exchange-Traded Funds (ETFs) experienced net outflows for two consecutive trading days.

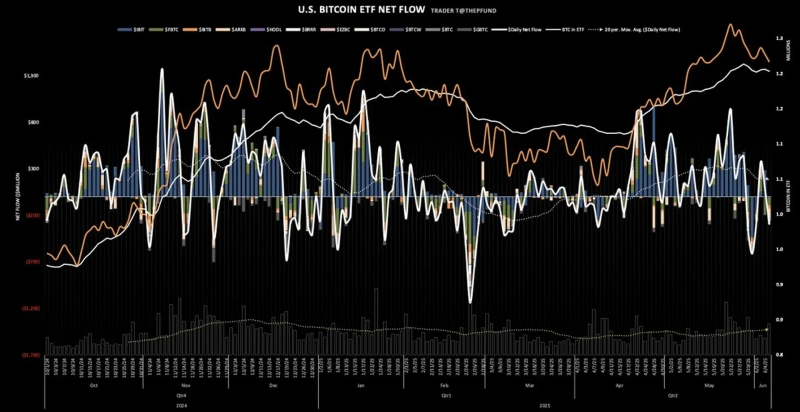

According to data from trader T on the 6th (local time), Bitcoin spot ETFs traded in the US saw an outflow of $48.80 million. While products from Fidelity Investments, Bitwise Asset Management, ARK Invest, and VanEck recorded net inflows, a net outflow of $131.45 million from BlackRock's 'IBIT' was the main reason for the overall result.

No net inflow or outflow was observed for Grayscale Investments' 'GBTC', WisdomTree's 'BTCW', Franklin Templeton's 'EZBC', Invesco's 'BTCO', and Valkyrie Investments' 'BRRR'.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)