Summary

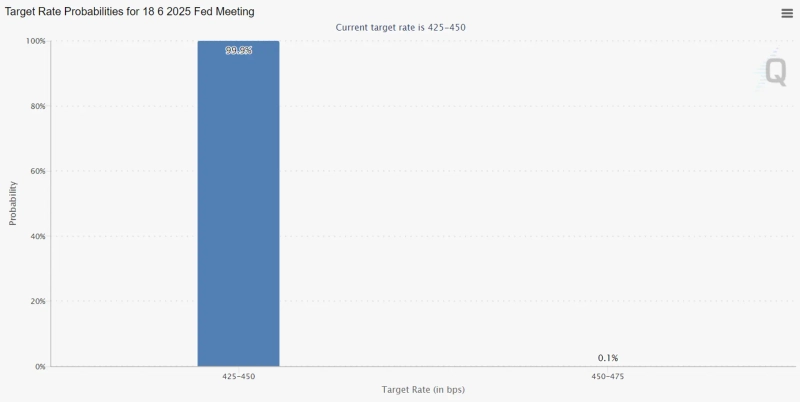

- According to FED Watch, there is a 99.9% probability that the Fed will hold interest rates steady at the June FOMC meeting.

- Despite President Donald Trump’s pressure for a benchmark rate cut, the market still sees a rate freeze as the prevailing view.

- BlackRock’s Rick Rieder, CIO, forecasts that the Fed will refrain from any major measures for a while, citing the strong performance of the U.S. services sector and only moderate slowdown in employment.

Despite continued pressure from former U.S. President Donald Trump to cut the benchmark interest rate, it appears that a rate freeze in June is virtually set.

As of 8:50 AM on the 9th (KST), according to FED Watch, the probability that the Fed will hold the benchmark rate at the upcoming Federal Open Market Committee (FOMC) meeting on the 18th is 99.9%. At the same time, the probability of a rate hike was 0.1%, and the probability of a rate cut was 0%.

This outlook arises even as President Trump is urging Fed Chair Jerome Powell to reduce the benchmark rate. Earlier, on the 6th, President Trump, through his social media (SNS) Truth Social, urged that if Chair Powell lowers the benchmark rate, both long-term and short-term treasury yields will drop significantly, emphasizing the need for a rate cut.

Furthermore, on the previous day aboard his private aircraft, President Trump added, "(A decision about the Fed chair) will be coming soon," further pressuring Powell. Raising the issue of appointing a new Fed chair is considered the highest level of pressure Trump can exert on Powell.

Despite President Trump’s hardline stance, the market still expects a rate freeze to prevail. Rick Rieder, BlackRock’s Global Chief Investment Officer for Fixed Income, predicted, "At the June FOMC, the Fed will hold rates steady." CIO Rieder added, "The U.S. economy is doing well because sectors like services are strong," and "although there is a slowdown in employment, it is not severe, so the Fed is unlikely to take any significant action for a while."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)