Summary

- It has been reported that concerns over the debt risks of companies incorporating "Bitcoin Treasury" as a strategic asset are being raised within the industry.

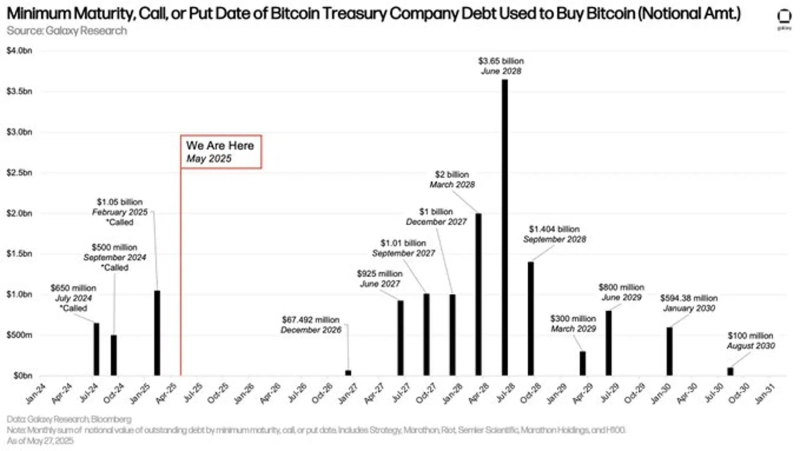

- Alex Thorn, Head of Research at Galaxy Digital, stated that the debt levels of these companies are exaggerated and that most of their maturities are more than two years away.

- Large debts that were scheduled to mature in 2024 and 2025 have already been repaid, and the largest debt maturity is now scheduled for June 2028.

Recently, as the number of companies incorporating Bitcoin Treasury as a strategic financial asset increases worldwide, there have been opinions suggesting that concerns about these companies are excessive.

On the 9th (KST), Alex Thorn, Head of Research at Galaxy Digital, stated via X (formerly Twitter), "I'm aware that the industry is concerned about the debt issues of Bitcoin Treasury companies," but added, "I think these fears are exaggerated."

He continued, "In reality, the debt is not that significant, and most of it matures after more than two years."

According to the chart shared by Thorn, $650 million of debt scheduled to mature in July 2024, $500 million due in September 2024, and $1.05 billion due in February 2025 have all been successfully repaid.

Currently, the period with the largest amount of upcoming debt maturities is June 2028, with $3.65 billion scheduled for repayment.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)